Delve into the reasons behind the latest US credit rating downgrade, its potential impact on fiscal policy, national debt, and your financial outlook.

Moody’s negative outlook on US credit sparks concerns. Understand this potential US credit rating downgrade, fiscal worries, and debt impact.

2. Introduction

Did news of Moody’s outlook change on the US credit rating send a shiver down your spine, or leave you wondering what it all means? You’re not alone. When a major rating agency signals concerns about the world’s largest economy, it’s natural to feel a sense of unease and a desire for clarity. The recent decision by Moody’s to shift its outlook on the U.S. government’s ratings to negative, while affirming the Aaa rating, closely follows a US credit rating downgrade by Fitch earlier in the year, and echoes the historic S&P downgrade in 2011. This isn’t just financial jargon; it’s a critical indicator of the nation’s financial health, reflecting mounting worries over fiscal deficits and the ballooning national debt.

This post will cut through the noise. We’ll explore why this US credit rating downgrade (or negative outlook, which can precede a downgrade) is significant, what led to Moody’s decision, and the potential ripple effects on the economy, interest rates, and even your personal finances. By the end, you’ll have a clearer understanding of the implications and why this issue demands everyone’s attention.

Understanding Credit Ratings and Rating Agencies

Think of a credit rating for a country like a credit score for an individual. It’s an assessment by independent agencies of a government’s ability and willingness to meet its debt obligations on time and in full. The “big three” credit rating agencies are Moody’s Investors Service, S&P Global Ratings (S&P), and Fitch Ratings. Their ratings influence investor confidence and the interest rates a country pays to borrow money. A higher rating (like Aaa/AAA) means lower risk, while a US credit rating downgrade signals increased risk.

Moody’s Aaa Rating Affirmed, But Outlook Turns Negative: What Does It Mean?

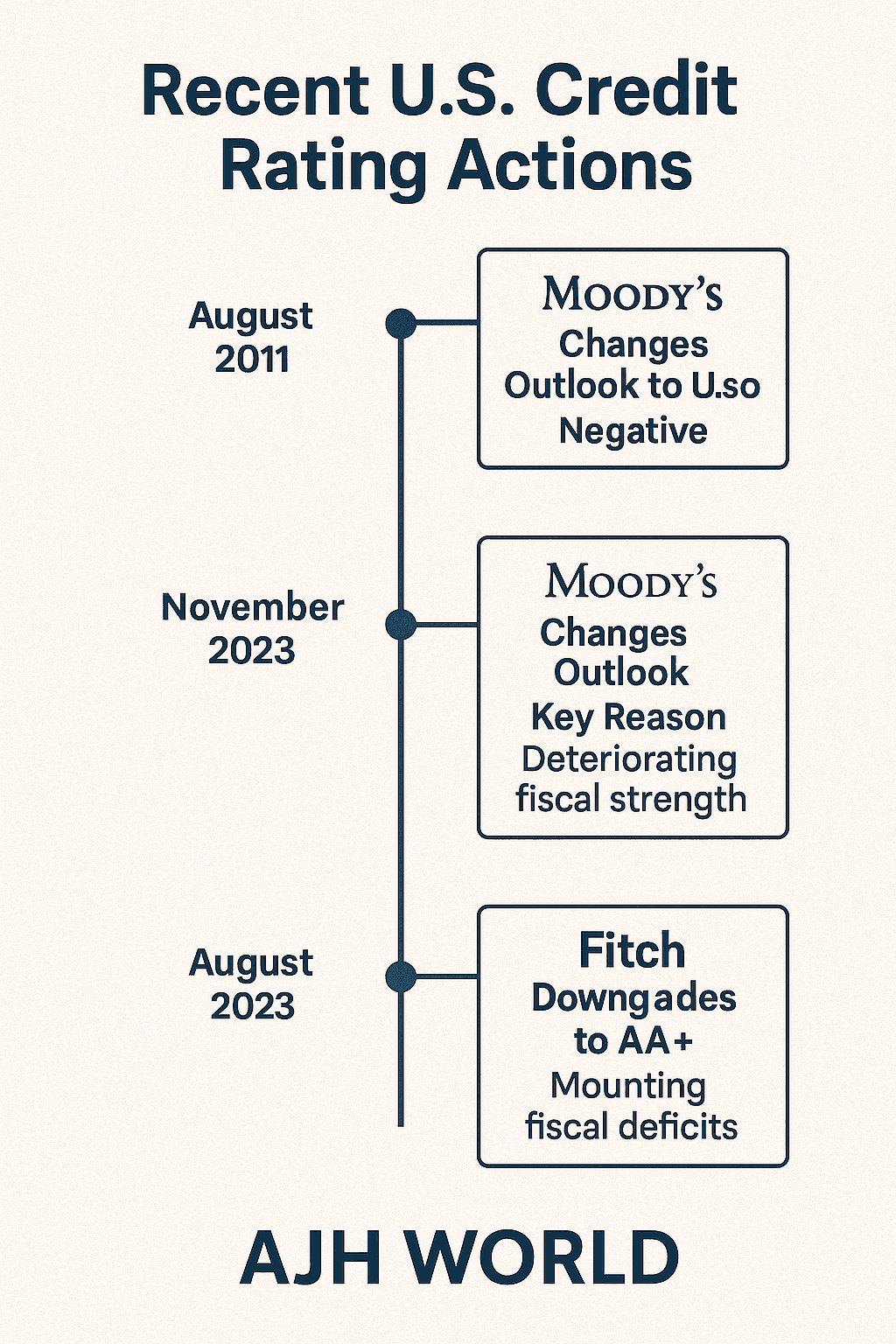

In November 2023, Moody’s affirmed the U.S. government’s top-tier Aaa credit rating but shifted its outlook from “stable” to “negative.” This was a significant move.

The Distinction: Rating vs. Outlook

-

Rating: This is the current assessment of creditworthiness (e.g., Aaa, Aa1, Aa2). Moody’s kept the US at Aaa, its highest rating.

-

Outlook: This indicates the likely direction of a rating over the medium term (typically 12-18 months). A “negative” outlook means there’s an increased chance of an actual US credit rating downgrade in the future if the underlying concerns aren’t addressed.

Why the Negative Outlook Now?

Moody’s specifically cited:

-

Large fiscal deficits: The US government continues to spend significantly more than it earns, contributing to rising debt.

-

Declining debt affordability: Higher interest rates mean the cost of servicing the existing national debt is increasing substantially.

-

Political polarization: Continued political infighting, especially around fiscal decisions (like the debt ceiling), raises concerns about the government’s ability to implement effective fiscal policy. This was a key factor in Fitch’s US credit rating downgrade earlier in 2023.

Echoes of the Past: Comparing with Fitch’s Downgrade and S&P’s 2011 Action

Moody’s move wasn’t in a vacuum.

-

Fitch Ratings (August 2023): Fitch downgraded the US credit rating from AAA to AA+. They cited expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to other highly-rated peers, particularly noting repeated debt-limit standoffs.

-

S&P Global Ratings (August 2011): S&P delivered the first-ever US credit rating downgrade from AAA to AA+, largely due to political brinkmanship over the debt ceiling and concerns about the long-term fiscal path. While the immediate market reaction was volatile, the US maintained its status as a haven for investors.

These events highlight a persistent theme: ongoing fiscal challenges and governance issues impacting perceptions of US creditworthiness.

Key Drivers Behind the US Credit Rating Downgrade Concerns

Several interconnected factors are fueling these worries:

Persistent Fiscal Deficits

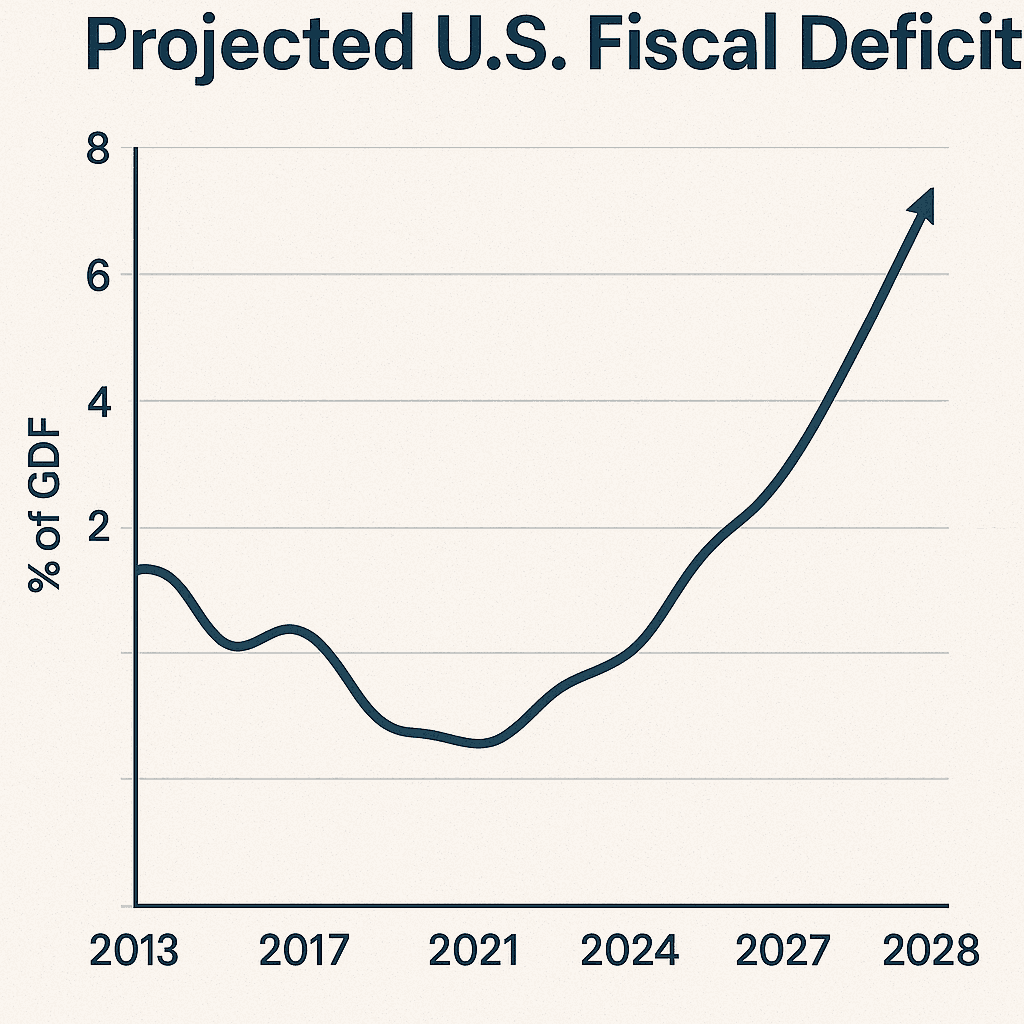

The U.S. has been running significant budget deficits for years, exacerbated by responses to the 2008 financial crisis, the COVID-19 pandemic, tax cuts, and increased spending. These deficits add to the national debt.

Rising National Debt Burden

As of late 2023, the US national debt exceeded $33 trillion. While the absolute number is striking, economists often look at debt as a percentage of GDP. This ratio has also been on an upward trajectory, causing concern about its sustainability.

Political Polarization and Governance Challenges

Rating agencies are increasingly vocal about how political divisions impact fiscal stability. Difficulties in reaching consensus on budgets, tax policy, and debt management (like the recurring debt ceiling dramas) contribute to uncertainty and are a core reason behind any potential US credit rating downgrade.

Higher Interest Rate Environment

After years of near-zero interest rates, the Federal Reserve has aggressively raised rates to combat inflation. This makes borrowing more expensive for everyone, including the US government. Higher interest payments on the national debt consume a larger portion of the federal budget, crowding out other priorities or leading to even more borrowing.

-

Read more about Understanding US Fiscal Policy and its Impact.

-

How does the National Debt Affect Individual Investors?

-

Explore our Economic Outlook for 2024.

-

View Moody’s official press release on their US sovereign rating outlook (Note: a direct link to the specific release would be ideal).

-

Learn about Fitch’s previous US credit rating downgrade decision (direct link preferred).

-

The Congressional Budget Office (CBO) provides in-depth analysis of the US budget and economic outlook.

8. Conclusion

The recent negative outlook from Moody’s on the US credit rating serves as another critical warning about the nation’s fiscal trajectory. While not a full US credit rating downgrade from this agency yet, coupled with Fitch’s earlier action and the historical S&P decision, it underscores persistent worries about deficits, rising debt, and political gridlock. These aren’t abstract economic concepts; they have tangible implications for government borrowing costs, market stability, and ultimately, the financial well-being of citizens.

Addressing these challenges requires a concerted effort towards responsible fiscal management and greater political consensus. For individuals, staying informed and understanding these dynamics is key to navigating the evolving economic landscape. The path ahead is complex, but recognizing the signals from institutions like Moody’s is the first step towards advocating for and adapting to a more sustainable fiscal future.

What are your thoughts on the US credit rating outlook and its potential impacts? Share your comments below, and subscribe for more insights on crucial economic developments!

Related Posts:

Leave a Comment