A potential Trump presidency brings new tariffs. Discover the 2025 market impact on your stocks, 401k, and savings. Our expert guide helps you prepare.

Your stocks, savings, and financial future could be on the line. Here’s a clear-eyed look at the risks, potential opportunities, and how to prepare.

What if we told you one of the biggest factors influencing your 401(k) in 2025 might not be interest rates or corporate earnings, but a single policy decision from a potential second Trump administration? As the 2024 election cycle looms, former President Donald Trump has floated the idea of sweeping new tariffs—a potential 10% universal baseline tariff on all imports and an astounding 60% or more on goods from China. The conversation is no longer theoretical; it’s a critical factor for every investor to consider.

Understanding the potential Trump tariff market impact 2025 is essential for safeguarding your financial well-being. This isn’t about political prediction; it’s about economic preparation. Past is often prologue, and the trade disputes of Trump’s first term gave us a clear playbook on how markets react to these protectionist measures.

In this comprehensive guide, we’ll break down everything you need to know. We will dissect the proposed tariffs, analyse which stock market sectors could win or lose, explore the ripple effects on your savings and the broader economy, and provide actionable strategies to position your portfolio for the potential volatility ahead.

What Exactly Are the Proposed 2025 Tariffs?

At the heart of the discussion are two major tariff proposals that have been publicly discussed:

- A Universal Baseline Tariff: This would impose a tariff of around 10% on all goods imported into the United States, regardless of their country of origin. The goal is to encourage domestic manufacturing and reduce the U.S. trade deficit.

- A Steep Tariff on Chinese Goods: This would be a much more aggressive measure, with potential tariffs of 60% or higher specifically on goods imported from China. This is framed as a tool to decouple the U.S. economy from its reliance on Chinese supply chains and penalize what are seen as unfair trade practices.

These aren’t minor adjustments; they represent a fundamental shift in U.S. trade policy that would create shockwaves across the global economy. The Trump tariff market impact 2025 would be driven by the uncertainty and direct financial costs these policies would create for thousands of companies.

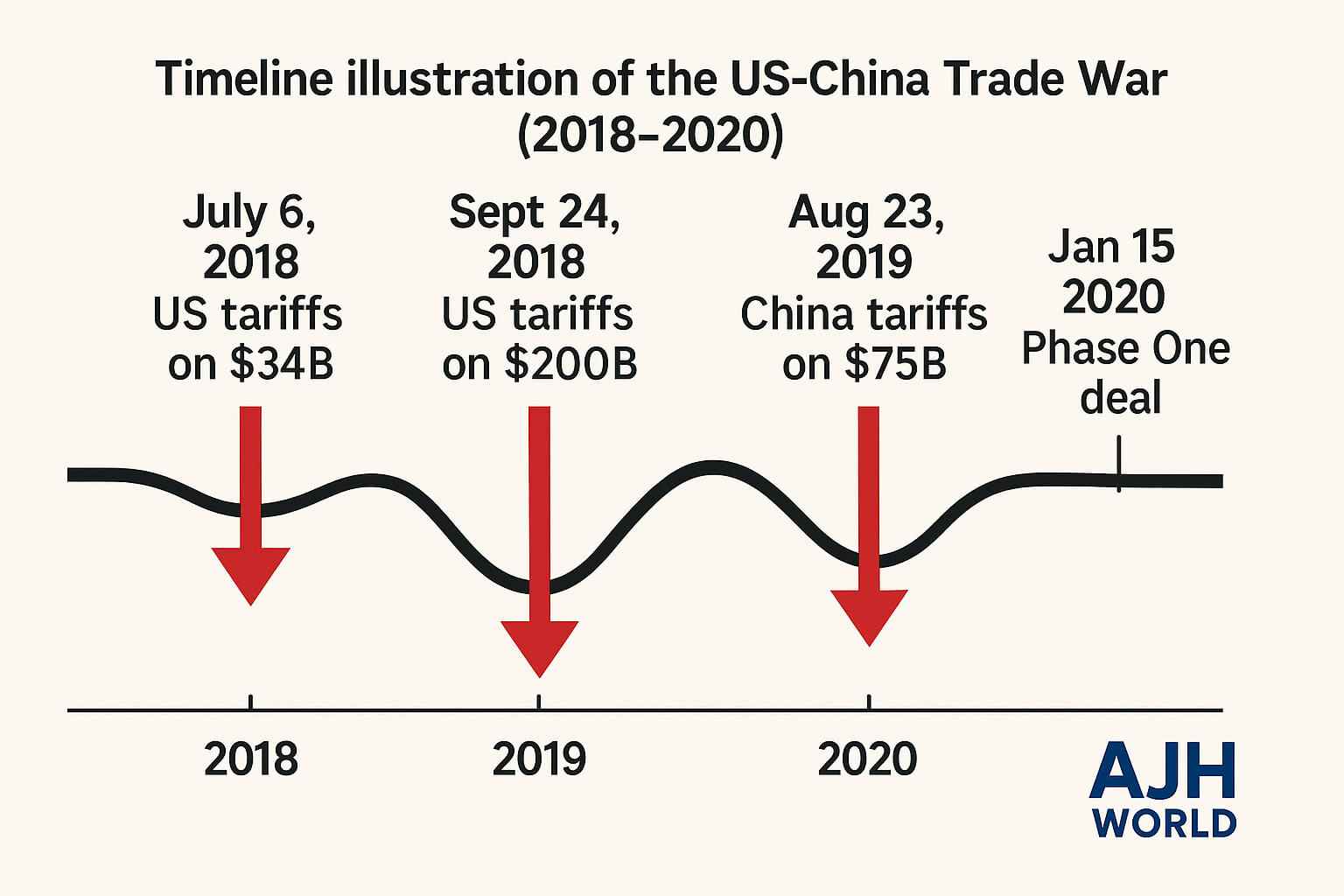

Lessons from the Past: How Markets Reacted to Trump’s First-Term Tariffs

We don’t have to guess in a vacuum. The 2018-2019 trade war provides a valuable case study. During that period, the Trump administration imposed tariffs on hundreds of billions of dollars worth of Chinese goods and materials like steel and aluminium from other countries. Read more Stay Cyber-Safe This Summer: Your Ultimate Guide to Free Training & 2025 Cybersecurity Awareness Trends

The market’s reaction was characterized by one word: volatility.

- Market Swings: The S&P 500 experienced significant dips every time new tariffs were announced or trade talks broke down. For example, in May 2019, when Trump threatened to increase tariffs, the market fell over 6%.

- Sector Divergence: Sectors heavily reliant on global supply chains (like Tech and Industrials) underperformed, while domestically-focused companies were more insulated.

- Business Uncertainty: Companies delayed investments and capital expenditures due to the unpredictable policy environment, which acted as a drag on economic growth.

While the market eventually recovered, the period was a stressful ride for investors and a clear warning of what could happen if these policies return on a larger scale.

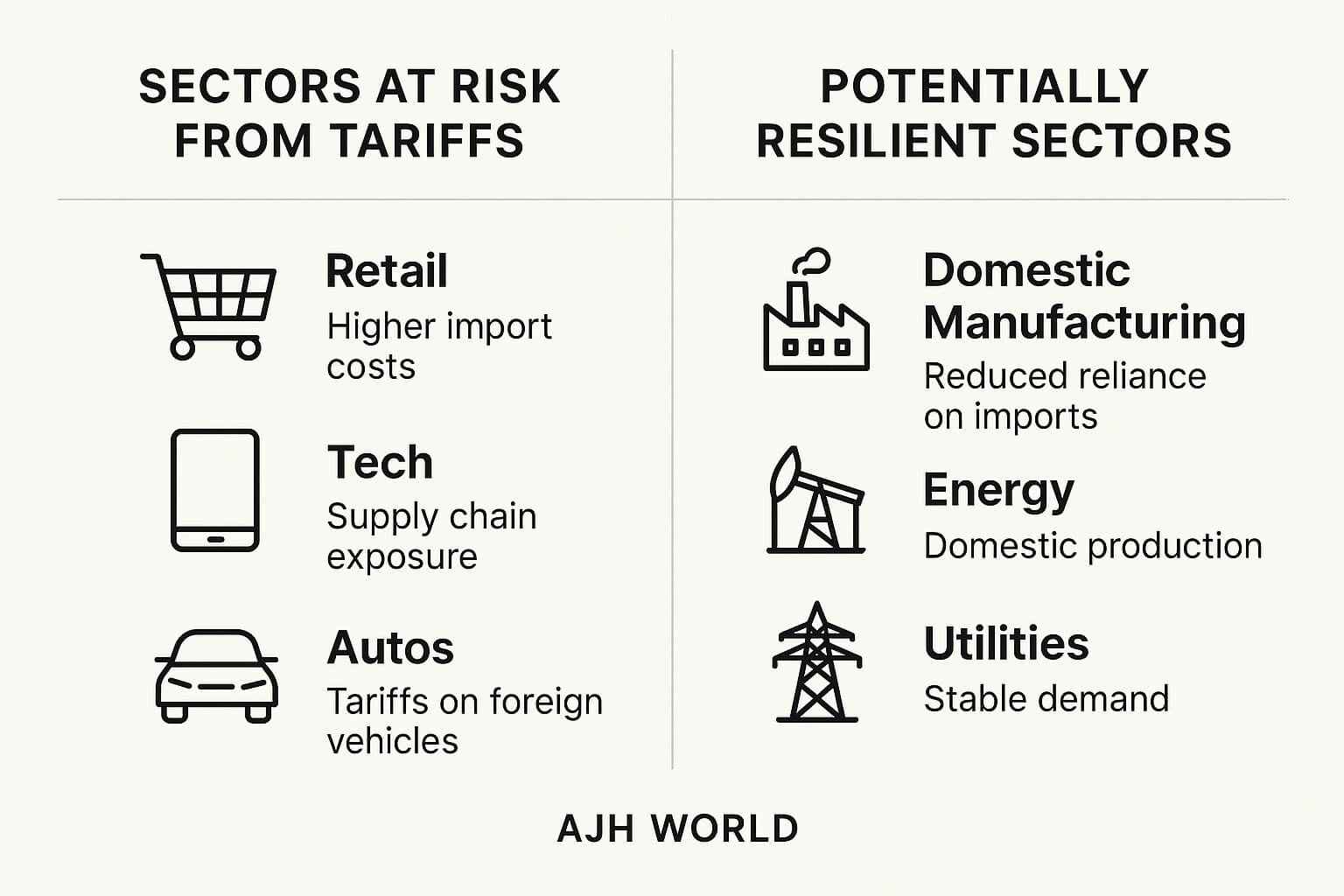

Sector-by-Sector Breakdown: Potential Winners and Losers

Not all stocks would be affected equally. The proposed tariffs would create clear winners and losers across the market.

Sectors Facing Headwinds (Potential Losers)

- Retail: Companies like Walmart, Target, and Best Buy, which import massive volumes of consumer goods from China and elsewhere, would face a direct hit. They would have to choose between absorbing the cost (hurting profit margins) or passing it on to consumers (risking lower sales).

- Technology: The tech supply chain is a global masterpiece of integration. Apple, for instance, assembles iPhones in China using components from around the world. Tariffs would dramatically increase production costs for hardware companies.

- Automakers: The modern car contains parts from dozens of countries. Tariffs on steel, aluminum, and electronic components would squeeze margins for giants like Ford and GM.

- Agriculture: While not a direct target, this sector is highly vulnerable to retaliatory tariffs. When the U.S. imposed tariffs in 2018, China responded by targeting American soybeans and other farm products, devastating many farmers.

Sectors That Could Potentially Benefit

- Domestic Manufacturing & Steel: The stated goal of tariffs is to make American-made goods more competitive. Companies in sectors like steel (e.g., U.S. Steel, Nucor) could see increased demand as foreign steel becomes more expensive.

- Certain Industrials: Companies that produce goods primarily for the U.S. market using domestically-sourced materials could gain a competitive advantage.

- Energy: The U.S. is a net energy exporter, making this sector less vulnerable to import tariffs and potentially benefiting from a stronger U.S. dollar, which can sometimes accompany protectionist policies.

The Ripple Effect: What Tariffs Mean for Inflation, Interest Rates, and Your Savings

The impact of tariffs extends far beyond corporate profits. Here’s how it could affect your wallet directly:

- Higher Prices (Inflation): This is the most direct consequence. A 10% tariff on imported goods means you could pay more for everything from clothing and electronics to furniture and groceries. A study by the National Bureau of Economic Research on the 2018 tariffs found the full cost was passed on to U.S. consumers.

- The Federal Reserve’s Dilemma: Higher inflation would put the Federal Reserve in a difficult position. To combat rising prices, they might be forced to keep interest rates higher for longer, or even raise them further.

- Impact on Your Savings:

- Savings Accounts: Higher interest rates are good for your high-yield savings account, as you’ll earn more interest.

- Bonds: Existing bonds with lower yields would become less valuable.

- Cost of Borrowing: Mortgages, car loans, and credit card rates would all become more expensive, potentially slowing down the housing market and consumer spending.

Actionable Strategies: How to Prepare Your Investment Portfolio

While no one has a crystal ball, prudent preparation can help you weather potential volatility. This is not about panic-selling; it’s about strategic positioning.

- Diversify, Diversify, Diversify: This is the golden rule for a reason. Ensure your portfolio is spread across different asset classes (stocks, bonds, real estate) and geographies. Over-concentration in a few U.S. tech stocks could be risky.

- Favor Domestically-Focused Companies: Look for companies that generate the majority of their revenue within the U.S. and have simpler, domestic supply chains. These businesses are more insulated from trade disputes.

- Consider Defensive Sectors: During times of economic uncertainty, investors often flock to “defensive” sectors that provide essential services, like Utilities, Consumer Staples (food, beverages, household goods), and Healthcare.

- Maintain a Long-Term Perspective: Market timing is notoriously difficult. The worst thing to do is sell in a panic during a downturn. If your investment horizon is long (10+ years), stick to your plan and continue contributing to your retirement accounts like your 401(k) and IRA. Check out our Beginner’s Guide to Long-Term Investing for more on this.

Beyond a US-China Spat: The Global Reaction to New Tariffs

It’s a mistake to view these tariffs in isolation. Key U.S. trading partners like the European Union, Canada, and Mexico would almost certainly not stand by idly. The most significant risk is a cycle of retaliatory tariffs, where other countries impose their own taxes on American-made goods.

This could trigger a full-blown global trade war, disrupting supply chains, increasing costs for everyone, and creating a drag on global GDP. Organizations like the Brookings Institution have extensively modelled these scenarios, often concluding that they result in a net negative for all economies involved. This global escalation is a major component of the potential Trump tariff market impact 2025.

Frequently Asked Questions (FAQs) – Trump Tariffs and Your Finances

A tariff is a tax imposed by a government on imported goods or services. For example, a 10% tariff on a $1,000 imported television means the importer must pay a $100 tax, raising the total cost to $1,100. The goal is to make foreign goods more expensive to encourage domestic purchasing.

Yes, it’s likely to increase market volatility. Your 401(k) could experience sharp fluctuations. A broader market downturn may occur as investors react to potential declines in corporate profits and global trade tensions.

Companies with mostly domestic operations may perform better, such as:

- U.S. Steel manufacturers (e.g., Nucor)

- Domestically focused banks

- Utility companies

- Brands with “Made in America” appeal

Note: This is not investment advice. Always do your own research.

The 2025 proposal is much broader. A universal 10% tariff and a potential 60%+ tariff on China go far beyond the more targeted tariffs of Trump’s first term. This could lead to greater market disruption and global economic friction.

Diversify. Keep a 3–6 month emergency fund in a high-yield savings account. Consider low-risk assets like Treasury bills or I-Bonds. Explore our guide to building a resilient financial plan for additional strategies.

Navigating the investment landscape of 2025 requires looking beyond traditional metrics and toward the political stage. The prospect of sweeping new tariffs under a second Trump administration is one of the most significant variables facing investors today.

The key takeaways are clear: expect volatility, understand that certain sectors like retail and tech are highly exposed, and recognize the knock-on effects for inflation and interest rates. By analysing the potential Trump tariff market impact 2025, you empower yourself to make informed, strategic decisions rather than emotional, reactive ones.

The best defense is a well-thought-out offense: a diversified portfolio, a focus on the long term, and a clear understanding of your own risk tolerance. By staying informed and prepared, you can navigate the coming shockwaves and protect your financial future.

What are your biggest concerns about new tariffs? Share your thoughts in the comments below!

John Miller is a certified financial planner (CFP) with over 15 years of experience helping individuals navigate complex market environments. He specializes in long-term investment strategy and retirement planning, with a focus on making financial concepts accessible to everyone.

Leave a Comment