Secure Your Future and Sleep Soundly: A Beginner’s Roadmap to Building a Financial Safety Net for Unexpected Life Events.

Learn how to create your first emergency fund with our step-by-step guide. Build financial security, cover unexpected expenses, and gain peace of mind today!

2. Introduction

Ever felt that jolt of panic when an unexpected bill lands on your doorstep? A sudden car repair, an urgent medical expense, or even a job loss can throw your financial life into chaos if you’re unprepared. This is precisely why understanding how to create your first emergency fund isn’t just good financial advice; it’s a foundational pillar of financial security and peace of mind. An emergency fund acts as your personal safety net, cushioning you against life’s inevitable curveballs without derailing your long-term financial goals or forcing you into high-interest debt.

This comprehensive guide will walk you through exactly what an emergency fund is, why it’s crucial, and, most importantly, a clear, actionable, step-by-step process on how to create your first emergency fund, even if you’re starting from scratch. By the end of this post, you’ll have the knowledge and confidence to build a robust financial cushion, paving the way for a more secure and less stressful financial future.

What Exactly IS an Emergency Fund?

An emergency fund is a stash of money set aside specifically to cover large, unforeseen expenses. Think of it as your financial fire extinguisher – you hope you never need it, but you’re incredibly relieved it’s there when a crisis erupts. It’s not an investment fund designed for growth, nor is it a piggy bank for planned purchases like a vacation or a new gadget. Its sole purpose is to provide a financial buffer during genuine emergencies, preventing you from dipping into long-term investments or accruing costly debt. Knowing how to create your first emergency fund is about building this essential financial safeguard.

Why is Learning How to Create Your First Emergency Fund So Crucial?

Life is unpredictable. While we can’t control when an emergency strikes, we can control how prepared we are. Without an emergency fund:

-

You might accrue high-interest debt: Credit cards or personal loans become the go-to, leading to a cycle of debt.

-

You might derail long-term goals: Cashing out retirement savings or investments prematurely can have significant financial consequences.

-

You’ll experience significant stress: Financial worries compound the stress of the emergency itself.

-

You could miss opportunities: Sometimes, an “emergency” might be an unexpected opportunity that requires quick cash (though this should be a secondary consideration).

A well-stocked emergency fund provides:

-

Peace of Mind: Knowing you can handle a financial shock significantly reduces stress.

-

Financial Stability: It prevents a single event from causing a financial meltdown.

-

Decision-Making Power: You won’t be forced into desperate financial choices.

1: Define What Constitutes an “Emergency” For You

Before you start saving, it’s vital to clarify what this money is for. This helps prevent misuse. Generally, an emergency is:

-

Urgent: It requires immediate attention.

-

Unexpected: You couldn’t have reasonably planned for it.

-

Necessary: It’s essential for your well-being or ability to earn an income (e.g., emergency medical care, urgent home repair like a burst pipe, job loss).

Examples of valid emergencies:

-

Job loss or significant income reduction

-

Unexpected medical or dental bills

-

Urgent home repairs (e.g., broken furnace in winter)

-

Essential car repairs

-

Unexpected but necessary travel (e.g., for a family emergency)

What it’s not for:

-

Planned vacations

-

Holiday shopping

-

Down payment on a non-essential item

-

Concert tickets

Clarity here is key when learning how to create your first emergency fund.

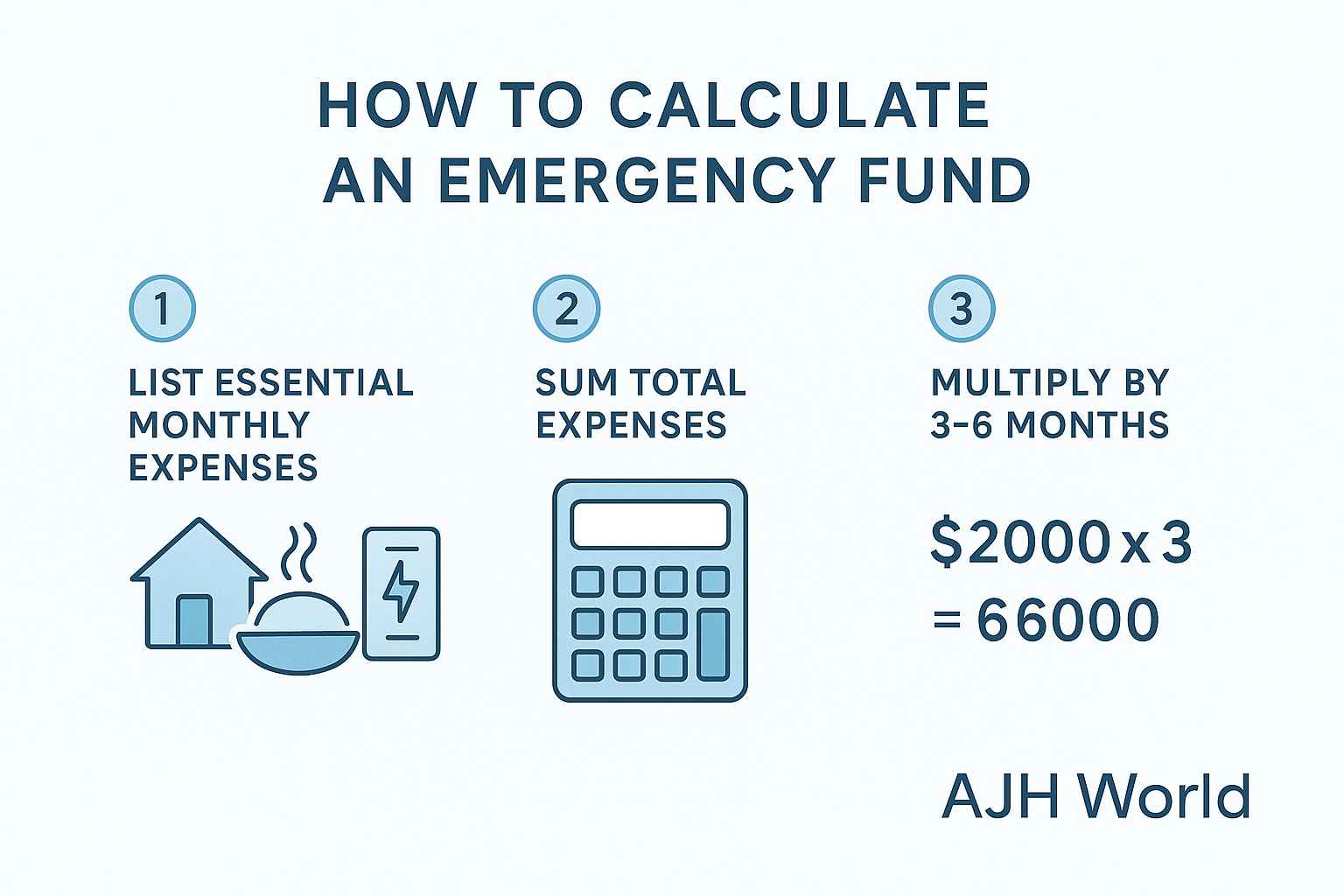

2: Calculate How Much You Need in Your Emergency Fund

This is a cornerstone of successfully figuring out how to create your first emergency fund.

The 3-6 Months Rule

A common rule of thumb is to save 3 to 6 months’ worth of essential living expenses.

-

Essential expenses include: rent/mortgage, utilities, food, transportation, insurance premiums, and minimum debt payments.

-

They do not include discretionary spending like dining out, entertainment, or vacations.

To calculate this:

-

List all your monthly essential expenses.

-

Add them up to get your total monthly essential expenses.

-

Multiply this total by 3 (for a minimum fund) and by 6 (for a more robust fund).

-

Example: If your essential monthly expenses are $2,000, your emergency fund target would be $6,000 (3 months) to $12,000 (6 months).

-

Factors Influencing Your Target Amount

-

Job Stability: If your income is irregular or your job is less secure, aim for 6 months or more.

-

Dependents: If you have children or support other family members, a larger fund is wise.

-

Health Status: If you have pre-existing health conditions or high-deductible health insurance, you might need more.

-

Debt Levels: High-interest debt might make it harder to save, but an emergency fund can prevent you from adding more. Some prioritize a smaller “starter” emergency fund ($1,000) before aggressively tackling debt, then build it up further.

-

Risk Tolerance: How comfortable are you with financial uncertainty?

3: Open the Right Kind of Savings Account

Where you keep your emergency fund matters almost as much as having one. The ideal account should be:

-

Liquid: You need to access the money quickly and easily in an emergency.

-

Separate: Keep it apart from your regular checking account to avoid accidental spending.

-

Interest-Bearing (Ideally): While not the primary goal, earning some interest helps offset inflation.

Accessibility vs. Temptation

It needs to be accessible, but not too accessible. If it’s too easy to dip into for non-emergencies, it defeats the purpose.

Recommended Account Types

-

High-Yield Savings Account (HYSA): Often offered by online banks, these typically provide much better interest rates than traditional brick-and-mortar bank savings accounts. They are FDIC/NCUA insured.

-

Money Market Account (MMA): Similar to HYSAs, they might offer check-writing privileges or a debit card, but sometimes require higher minimum balances. Also insured.

Avoid investing your emergency fund in the stock market or other volatile assets, as you could lose principal when you need it most.

4: Start Small & Build Momentum – Strategies to Save

Don’t be discouraged if your target amount seems daunting. The key is to start. Even saving $25 or $50 a week makes a difference over time. Consistency is more important than amount, especially when first figuring out how to create your first emergency fund.

Automate Your Savings

This is the most effective strategy. Set up an automatic transfer from your checking account to your emergency fund savings account each payday. Treat it like any other bill.

The “Pay Yourself First” Method

Before you pay any bills or spend on discretionary items, transfer a predetermined amount to your emergency fund.

Cut Unnecessary Expenses

-

Track your spending for a month to identify areas where you can cut back (e.g., daily coffees, unused subscriptions, excessive dining out).

-

Redirect these savings directly into your emergency fund.

-

Example: Cutting a $5 daily coffee habit saves $150/month.

-

Find Ways to Increase Income

-

Consider a side hustle, freelancing, or selling unused items.

-

Allocate any windfalls (tax refunds, bonuses) directly to your emergency fund until it’s fully funded.

5: Where to Keep Your Emergency Fund for Optimal Balance

As mentioned in Step 3, a high-yield savings account (HYSA) is often the best choice for your emergency fund.

-

Safety: FDIC or NCUA insurance protects your deposits up to $250,000 per depositor, per insured bank, for each account ownership category.

-

Accessibility: Most HYSAs allow quick electronic transfers to your checking account, usually within 1-3 business days. Some may offer ATM cards.

-

Growth: While modest, the interest earned helps your money keep pace with (or at least close to) inflation, preserving its purchasing power.

Compare offers from reputable online banks to find the best rates and features. Don’t chase the absolute highest rate if it means sacrificing convenience or dealing with a less reputable institution. This step is crucial for maximizing the benefit as you learn how to create your first emergency fund.

6: Protect Your Fund – When to Use It (and When Not To)

Once you’ve built up your emergency fund, guard it fiercely. Only use it for genuine emergencies, as defined in Step 1.

-

Before using it: Pause and ask, “Is this truly an unexpected, urgent, and necessary expense?”

-

Avoid temptation: Don’t use it for vacations, a new TV, or because your checking account is low due to overspending on non-essentials.

-

Explore alternatives: For non-emergencies, consider saving separately or adjusting your budget.

If you do need to use your emergency fund, don’t feel guilty – that’s what it’s for! Your next priority will be to replenish it.

7: Review and Replenish Your Emergency Fund Regularly

Your financial life isn’t static, so your emergency fund shouldn’t be either.

-

Annual Review: At least once a year, or after a significant life event (marriage, new job, birth of a child, major purchase like a home), reassess your target emergency fund amount. Have your essential expenses increased?

-

Replenish After Use: If you dip into your fund, make it a priority to rebuild it as quickly as possible. Go back to your saving strategies from Step 4.

Maintaining your emergency fund is just as important as creating it in the first place. This ensures your journey on how to create your first emergency fund leads to lasting security.

Common Mistakes to Avoid When Building Your Emergency Fund

-

Not Starting: Procrastination is the biggest enemy. Any amount is better than zero.

-

Setting an Unrealistic Goal Too Soon: Don’t get discouraged. Aim for a small “starter” fund first (e.g., $1,000 or one month’s expenses), then build from there.

-

Keeping it in Your Checking Account: This makes it too easy to spend accidentally.

-

Investing it Aggressively: The risk of loss outweighs potential gains for emergency money.

-

Forgetting to Replenish: After an emergency, make rebuilding the fund a top priority.

-

Not Adjusting for Life Changes: Your needs will evolve over time.

Q2: Where is the absolute best place to keep my emergency fund?

A2: The best place for most people is a high-yield savings account (HYSA). These accounts are typically FDIC or NCUA insured, offer better interest rates than traditional savings accounts, and keep the money separate yet accessible.

Q3: What if I have high-interest debt? Should I pay that off before learning how to create your first emergency fund?

A3: It's a balancing act. Many financial experts recommend saving a small starter emergency fund ($1,000 for example) first. This prevents you from going into more debt if a small emergency occurs. After that, you can aggressively tackle high-interest debt while slowly continuing to build your emergency fund.

Q4: Can I use my emergency fund for a planned expense if I promise to pay it back?

A4: It's highly discouraged. An emergency fund is strictly for unexpected and urgent necessities. Using it for planned expenses, even with good intentions to replenish it, blurs its purpose and may leave you vulnerable if a real emergency strikes before you've paid it back. Save separately for planned expenses.

Q5: How quickly should I be able to access the money in my emergency fund?

A5: You should be able to access your emergency fund within 1-3 business days. Most HYSAs allow for electronic transfers to your checking account within this timeframe. Avoid locking it up in accounts with withdrawal penalties or longer access times.

Q6: Is it okay if I only have a small amount I can save towards my emergency fund each month?

A6: Absolutely! Consistency is more important than the amount when you're starting. Saving $20 a month is better than saving nothing. The habit of saving will build momentum, and as your financial situation improves, you can increase the amount. Learning how to create your first emergency fund is a marathon, not a sprint.

8. Conclusion

Learning how to create your first emergency fund is one of the most empowering steps you can take towards achieving genuine financial security and peace of mind. It’s your personal safety net, ready to catch you when life throws those inevitable curveballs. By understanding its importance, calculating your needs, choosing the right account, and consistently saving, you can build a financial cushion that protects you from debt and stress.

Remember, the journey starts with a single step. Don’t be overwhelmed by the final target; focus on getting started and building a consistent saving habit. The relief and confidence that come with a well-funded emergency savings account are invaluable.

Ready to take control? Start today! What’s the first small step YOU will take this week to build your emergency fund? Share your thoughts or questions in the comments below!

9. Author Bio & Related Posts

-

Author Bio: AJH World is dedicated to demystifying personal finance and empowering individuals to achieve financial freedom. With years of experience in [mention relevant experience, e.g., financial coaching, writing about finance], we provide practical, actionable advice to help you manage your money better and live a more secure life. Connect with us on AJH World FaceBook Page

-

Related Posts:

- Save Money Fast USA Canada: 20 Proven Ways to Boost Your Bank Account (Lifestyle Intact!)

-

The Ultimate Guide to Creating a Budget That Works

-

5 Simple Ways to Cut Your Monthly Expenses

-

Understanding High-Yield Savings Accounts: Are They Right For You?

-

How to Pay Off Debt Fast: A Proven Strategy

Leave a Comment