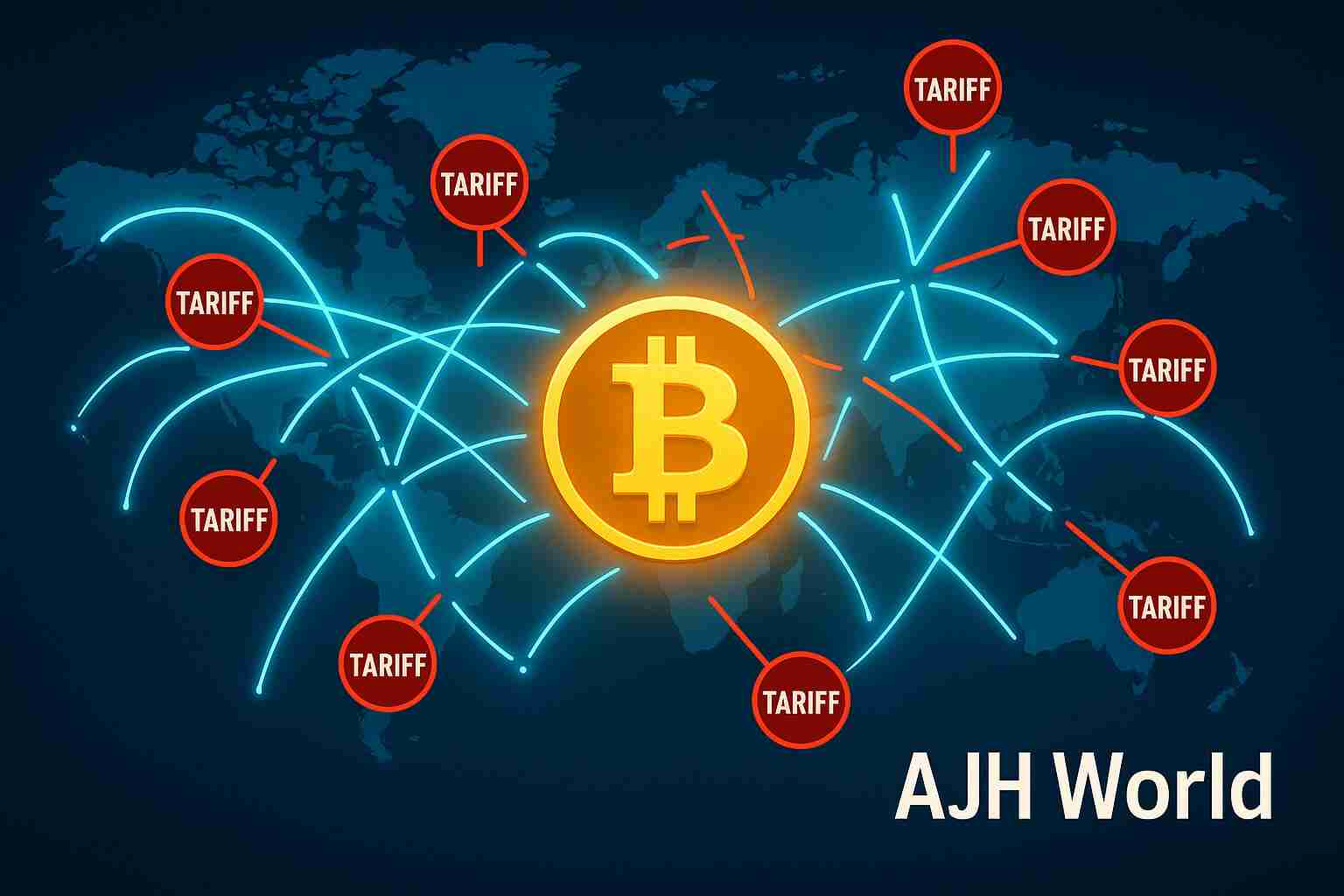

Discover why the 2025 Bitcoin price climb past $109k is directly linked to global tariffs and trade wars. Learn about the impact on BTC, dogecoin, and your portfolio.

Unpacking the shocking connection between global trade wars and the meteoric rise of digital currencies, and what it means for your portfolio.

he year is 2025, and the financial headlines are electrifying: Bitcoin has smashed through the $109,000 barrier, leaving traditional market analysts scrambling for answers. But the cause isn’t another celebrity endorsement or a viral meme. The primary driver is something far more fundamental, something that has been brewing in the backrooms of global power for years: aggressive international tariffs and restrictive trade policies.

The intricate dance between the Bitcoin Price and Tariff Impact 2025 is no longer a fringe theory discussed in niche forums; it is the most significant economic story of the year. As major economic blocs intensify their trade disputes, imposing steep tariffs on everything from technology to agricultural products, investors and everyday citizens are seeking a safe harbour from the ensuing currency devaluation and inflation. The data is clear: as protectionist policies rise, Bitcoin climbs.

In this deep dive, we’ll explore the exact mechanisms driving this phenomenon. You will learn:

- How 2025’s trade policies are creating unprecedented economic pressure.

- Why Bitcoin has emerged as the premier “digital life raft” for savvy investors.

- The surprising role of altcoins like Dogecoin in this new economic landscape.

- Actionable insights on how to navigate this volatile yet opportunity-rich market.

The 2025 Economic Chessboard: A World Shaped by Tariffs

To understand why Bitcoin is surging, we first need to understand the global economic environment of 2025. Following several years of escalating tensions, major nations have doubled down on protectionism. The landscape is defined by:

- Targeted Tech Tariffs: A new wave of tariffs targeting semiconductors, AI hardware, and consumer electronics has made these goods significantly more expensive for consumers in North America and Europe. This has fueled domestic inflation and strained corporate supply chains.

- Agricultural Trade Disputes: Retaliatory tariffs on agricultural products have created surpluses in some nations and shortages in others, disrupting food prices and creating social and economic instability.

- Currency Wars: Governments are intentionally devaluing their currencies to make their exports more attractive, a race to the bottom that erodes the savings of their citizens.

This environment of economic warfare has created a perfect storm. When the cost of goods rises and the value of your national currency falls, where do you put your money to preserve its value? For millions, the answer has been Bitcoin.

Bitcoin as the “Digital Life Raft”: Why Investors Are Flocking

Bitcoin’s core properties make it uniquely suited to thrive in this chaotic environment. Unlike traditional assets, it is decentralized, borderless, and has a finite supply—making it immune to the policy whims of any single government.

Hedging Against Inflation and Currency Devaluation

This is the primary driver. When a government imposes a 25% tariff on imported goods, the cost is passed on to consumers. Your dollar, euro, or yen now buys less than it did before. This is inflation. Bitcoin, with its hard-capped supply of 21 million coins, cannot be “printed” or inflated away by a central bank. It acts as a store of value, a “digital gold,” preserving wealth while fiat currencies weaken.

Circumventing Capital Controls and Trade Friction

For businesses and high-net-worth individuals, the challenge is moving money across borders. Strained diplomatic relations have led to slower, more expensive, and heavily scrutinized international bank transfers. Tariffs further complicate payment processing.

Bitcoin offers a near-frictionless alternative. A company in the U.S. can pay a supplier in Asia in minutes using the Bitcoin network, bypassing the legacy banking system and the direct impact of currency-related trade restrictions. This utility is a key component of the Bitcoin Price and Tariff Impact 2025.

A Response to Geopolitical Uncertainty

Stock markets are intrinsically tied to the economic health of their home countries. A new tariff announcement can send the Dow Jones or Nikkei tumbling. This volatility pushes investors towards assets that are uncorrelated with traditional markets. As news of another trade impasse hits the wire, Bitcoin climbs, acting as a global sentiment barometer for economic freedom.

The Ripple Effect: How Altcoins like Dogecoin Join the Rally

It’s not just Bitcoin experiencing a historic run. The entire crypto market is feeling the heat, including meme-coins like Dogecoin. But their role is different.

While Bitcoin is being adopted as a serious store of value (an inflation hedge), the massive influx of capital and media attention creates a “wealth effect” that spills over into more speculative assets. Here’s the dynamic:

- Market-Wide Exuberance: As Bitcoin mints new millionaires, some of that profit is diversified into higher-risk, higher-reward altcoins.

- Retail Speculation: New users, drawn in by Bitcoin’s headlines but perhaps priced out of buying a whole coin, turn to cheaper alternatives like Dogecoin. It becomes a speculative vehicle for those hoping to catch the next wave.

- Media Barometer: A surging Dogecoin price in 2025 serves as an indicator of peak retail frenzy, signaling that mainstream attention is at its zenith.

So, while the Bitcoin Price and Tariff Impact 2025 is rooted in sound economic principles of capital preservation, the surge in coins like Dogecoin is a secondary effect driven by market psychology and speculation.

By the Numbers: Data Showing the Correlation

The anecdotal evidence is strong, but the data from 2025 makes the case undeniable. Analytics firm CryptoQuant released a Q3 2025 report highlighting:

- A 0.78 positive correlation between the announcement of new U.S.-China tariffs and a spike in Bitcoin trading volume from East Asian and North American exchanges.

- Wallet flows show a consistent trend of capital moving from stablecoins (digital dollars) into Bitcoin within 24 hours of major negative trade policy announcements.

- On-chain data reveals that long-term holder supply is at an all-time high, indicating that investors are buying Bitcoin and holding it as a long-term hedge, not for quick trades.

This data proves that as governments build economic walls, the market is responding by moving capital into a decentralized, borderless system.

What This Means for the Future of Finance and Your Investments

The events of 2025 mark a turning point. The link between macroeconomic policy and cryptocurrency adoption is now proven. For investors, this new paradigm requires a strategic shift.

- Acknowledge Bitcoin as a Macro Asset: Bitcoin is no longer just a tech asset; it is a macroeconomic hedge, much like gold or bonds. It deserves a small, strategic allocation in a diversified portfolio.

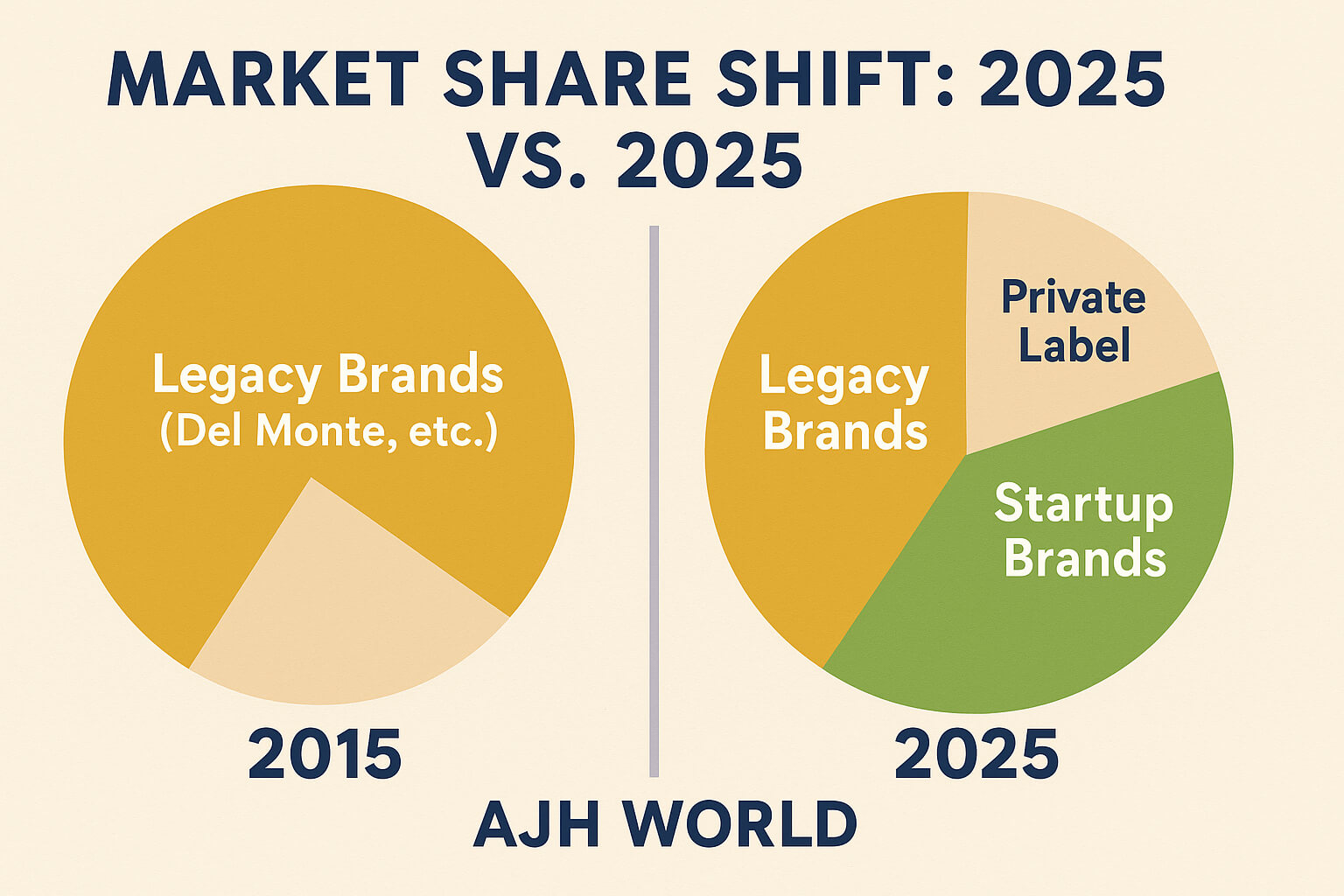

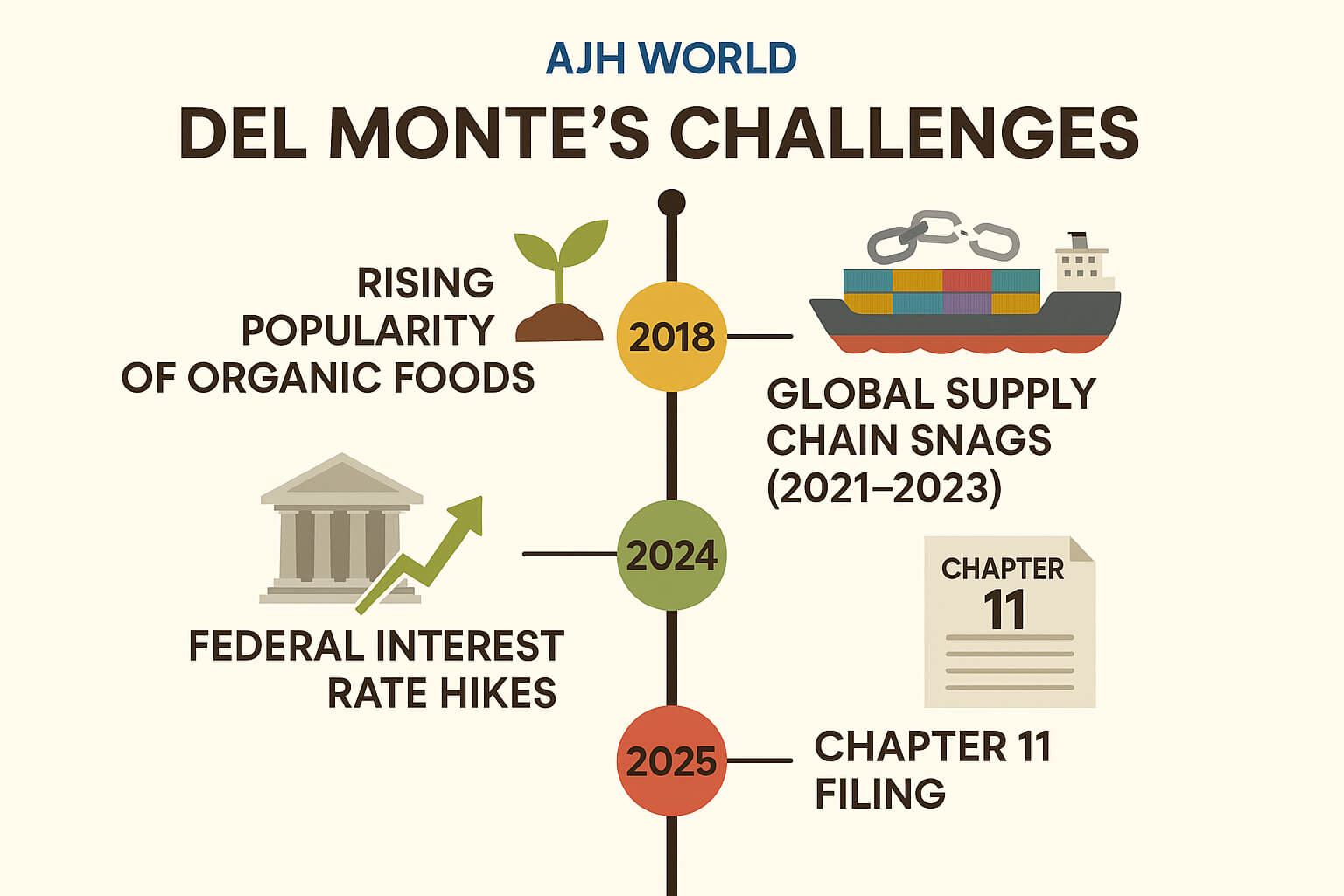

- Monitor Geopolitical Events: Trade negotiations, tariff announcements, and central bank policies are now direct signals for the crypto market. Watching C-SPAN can be as important as reading CoinDesk. (For more details, see our post onDel Monte Foods Bankruptcy 2025: Behind the $1 Billion Collapse of a Food Giant

- Differentiate Between Asset Classes: Understand the difference between Bitcoin’s role (store of value) and the role of altcoins like Dogecoin (speculation). Invest accordingly based on your risk tolerance.

This trend will likely force governments to accelerate their work on Central Bank Digital Currencies (CBDCs) in an attempt to retain control. As reported by the Brookings Institution, the race is on, but decentralized networks currently have the lead.

Frequently Asked Questions (FAQ)

Yes, in the context of 2025’s economic pressures, it is functioning as a relative safe haven. While its price is volatile day-to-day, its core value proposition as a hedge against systematic currency debasement and capital controls is what’s attracting long-term investors. Its volatility is seen as a worthwhile risk compared to the guaranteed loss of purchasing power from inflation.

Tariffs cause the Bitcoin price to climb through a clear chain reaction:

– Tariffs are imposed on goods.

– Consumer prices rise (inflation).

– The national currency (e.g., the dollar) buys less, losing value.

– Investors sell the weakening currency or assets tied to it.

– They buy Bitcoin as a store of value that’s immune to government inflation.

This increased demand causes the Bitcoin price to climb.

Dogecoin and other altcoins surged due to a “spillover effect.” As Bitcoin hit new all-time highs, it brought a massive wave of media attention, new users, and capital into the crypto market. This exuberance led investors, especially retail traders, to speculate on lower-priced altcoins like Dogecoin, hoping for similar explosive gains.

The biggest risks include regulatory crackdown, as governments may view this capital flight as a threat to their monetary sovereignty. Another risk is a market bubble; while driven by fundamentals, the excitement can lead to over-leveraging and a sharp, painful correction. Finally, a sudden de-escalation of trade wars could temporarily reverse the trend.

As long as major economies continue to rely on protectionist tariffs and engage in trade disputes that create global economic uncertainty, Bitcoin and other decentralized assets will likely remain an attractive alternative. The trend’s longevity is directly tied to the persistence of these macroeconomic pressures.

The story of 2025 is clear: we have entered a new era where monetary and trade policies are direct catalysts for cryptocurrency adoption. The stunning ascent of Bitcoin past $109,000 is not an anomaly; it is a logical market reaction to a world fracturing along economic lines. By creating inflation and friction, tariffs have inadvertently built the most compelling use case for a borderless, decentralized store of value.

Understanding the relationship between the Bitcoin Price and Tariff Impact 2025 is now crucial for anyone looking to preserve their wealth and navigate the future of finance. The signal is clear: as traditional systems falter, the world is voting with its capital, and Bitcoin climbs.

What are your thoughts on this trend? Do you believe trade policies will be the biggest driver for crypto in the coming years? Leave a comment below!

John Sterling is a senior financial analyst and crypto strategist with over a decade of experience in macroeconomic research. He specializes in how geopolitical events impact digital asset markets and is passionate about helping readers understand the future of finance.