In-depth analysis of the $1B Del Monte Foods Bankruptcy 2025. Discover what led to the collapse, who is affected—from farmers to consumers—and what comes next

How supply chain woes, changing tastes, and crushing debt brought down a 130-year-old American icon—and what it means for your pantry, your portfolio, and thousands of jobs.

The iconic red shield, a staple in American kitchens for generations, is facing its darkest hour. In a move that has sent shockwaves through the food industry and Wall Street, Del Monte Foods, Inc. has officially filed for Chapter 11 bankruptcy protection, citing over $1 billion in liabilities. The Del Monte Foods Bankruptcy 2025 is more than just a corporate headline; it’s a cautionary tale about legacy, adaptation, and the brutal pace of modern market forces.

For over a century, Del Monte has been synonymous with quality canned fruits and vegetables. But in a world demanding fresh, fast, and farm-to-table, has this American giant been left behind?

This in-depth analysis will dissect the entire story for you. We will uncover:

- The key factors that created a “perfect storm” for Del Monte’s collapse.

- A clear breakdown of who is most affected—from farmers to employees to consumers.

- What the Chapter 11 filing really means and what the future could hold.

- The critical lessons other legacy brands can learn from this monumental event.

The Shocking Announcement: A Deeper Look at the Chapter 11 Filing

The news broke on a Tuesday morning, catching many by surprise. Del Monte Foods, a company with roots tracing back to the 1880s, announced its voluntary petition for reorganization under Chapter 11 of the U.S. Bankruptcy Code.

It’s crucial to understand that Chapter 11 is not a liquidation. Unlike Chapter 7, which involves selling off all assets and closing down, Chapter 11 gives a company breathing room. It allows the business to continue operating while it develops a plan to restructure its finances, pay its debts over time, and hopefully emerge as a healthier, more viable company. Read More Google AI Mode in Search Is Here: India, Your Search Experience Just Changed Forever

However, this filing signals severe financial distress. Court documents reveal a complex web of secured and unsecured debts, with the company struggling to service loans amidst declining revenue and razor-thin profit margins. The primary goal now is to stabilize operations and negotiate with creditors to chart a path forward.

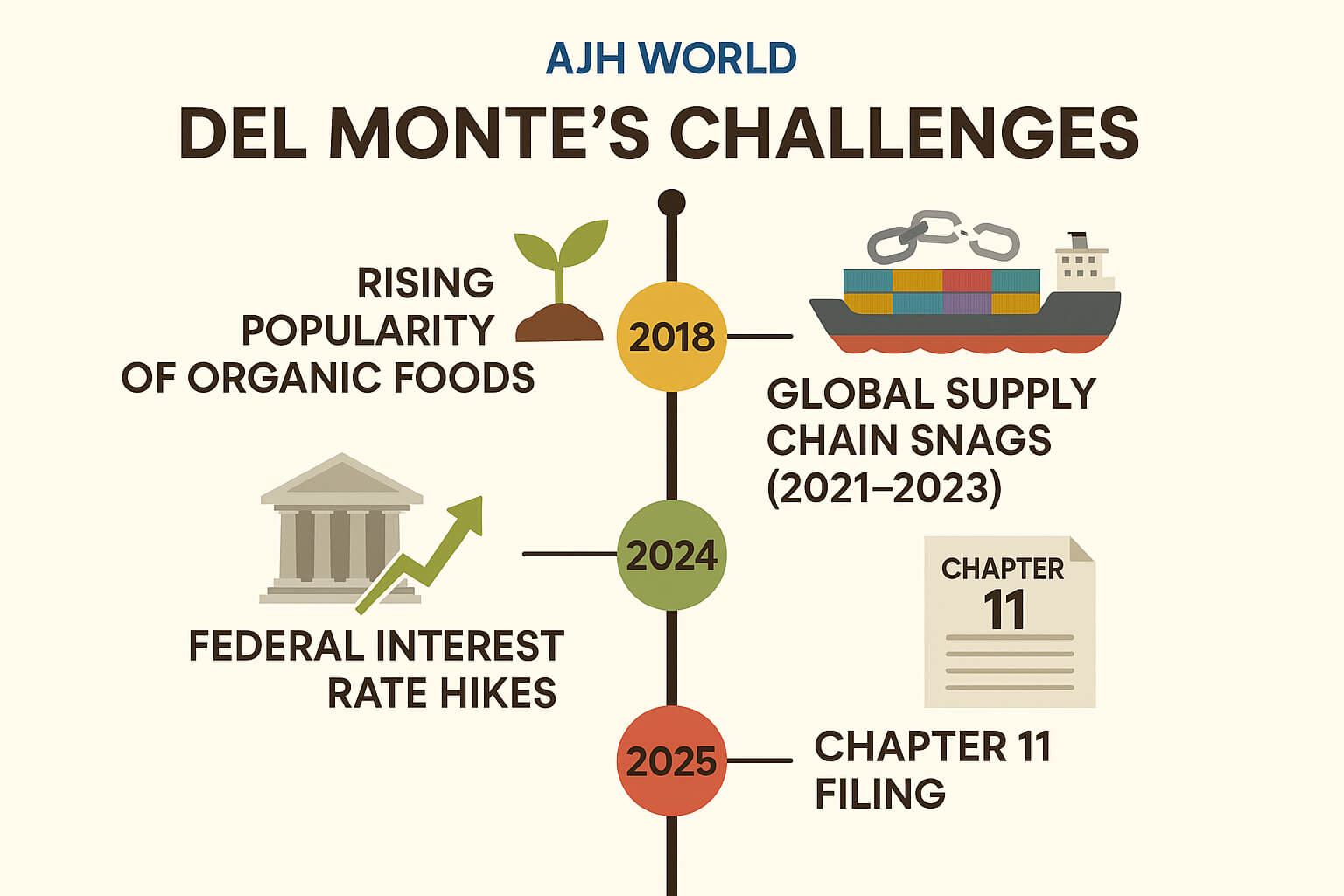

A Perfect Storm: The Key Factors Behind the 2025 Bankruptcy

No single issue led to the Del Monte Foods Bankruptcy 2025. It was a confluence of several powerful, long-brewing challenges that ultimately became insurmountable.

The Squeeze of Shifting Consumer Palates

The modern consumer’s mantra has become “fresh is best.” Shoppers today, particularly Millennials and Gen Z, increasingly favor:

- Fresh produce over canned alternatives.

- Organic, non-GMO, and locally sourced foods.

- Products with minimal processing and fewer preservatives.

While Del Monte made efforts to innovate with product lines like fruit cups and non-GMO labels, its core identity remained deeply tied to the center-aisle canned goods section—a part of the grocery store that has seen sluggish growth for a decade. The perception of canned food as “old-fashioned” or “less healthy” created a powerful headwind that marketing alone couldn’t overcome.

Unprecedented Supply Chain Volatility

Del Monte’s business model relies on a massive, complex agricultural supply chain. In recent years, this has become a significant vulnerability.

- Climate Impact: Increased frequency of droughts in California and hurricanes in Florida has disrupted crop yields for key products like tomatoes and peaches.

- Logistical Costs: Soaring fuel prices, driver shortages, and port congestion have dramatically increased the cost of transporting produce from farms to processing plants and finally to retailers.

- Packaging Costs: The price of steel (for cans) and paper (for labels) has surged due to inflation and global demand, directly eroding profit margins on every unit sold.

The Crushing Weight of Debt and Rising Interest Rates

A significant portion of Del Monte’s troubles can be traced back to its financial structure. Years ago, a leveraged buyout left the company with a substantial amount of debt. During the era of near-zero interest rates, this was manageable.

However, as central banks hiked interest rates aggressively through 2023 and 2024 to combat inflation, the cost of servicing that variable-rate debt skyrocketed. Suddenly, a large portion of the company’s cash flow was being diverted to interest payments instead of being reinvested in innovation, marketing, or infrastructure upgrades.

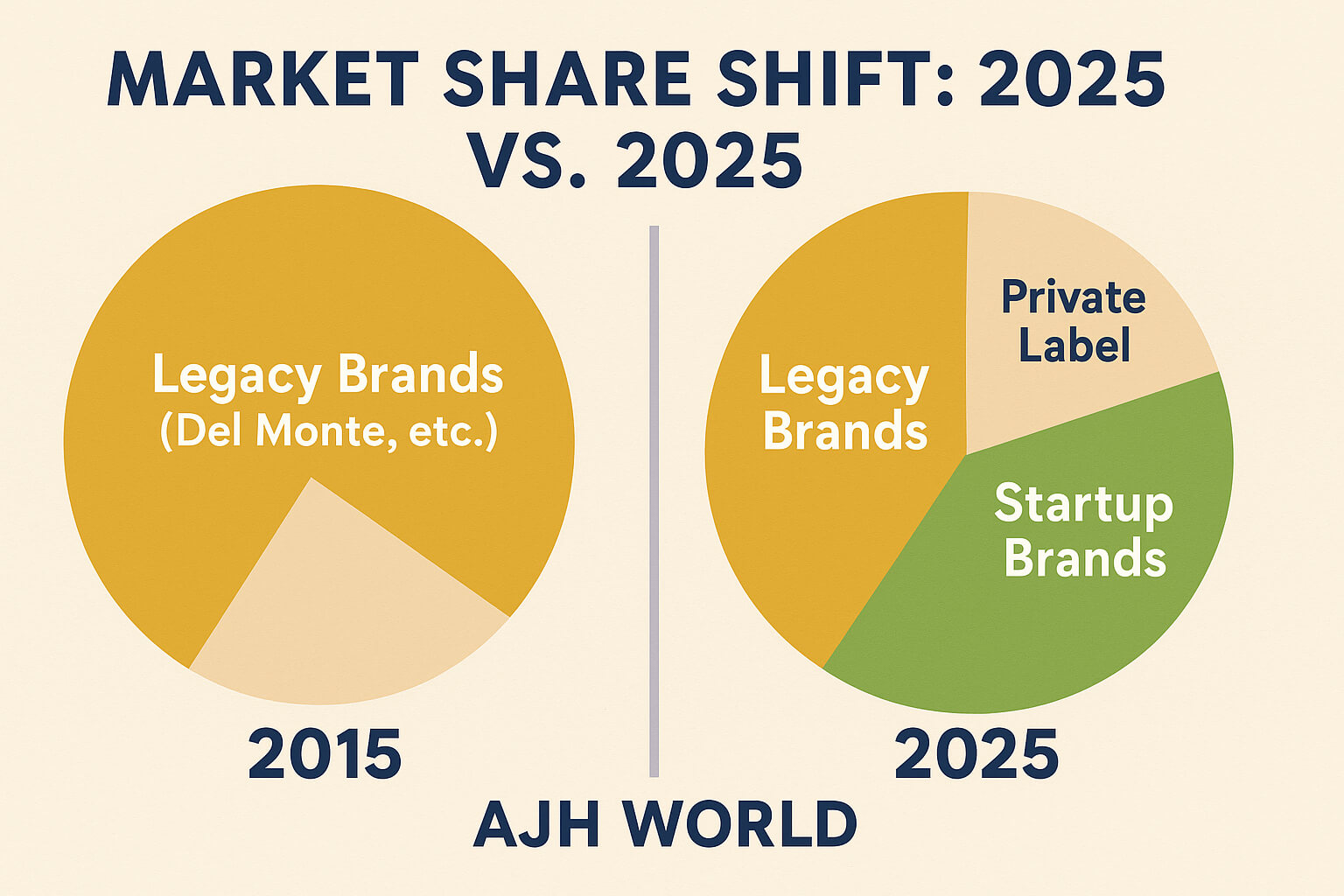

The Silent Threat: Private Labels and Nimble Competitors

Del Monte wasn’t just competing with Green Giant. Its biggest threat came from two different directions:

- Private Labels: Retail giants like Kroger, Walmart (Great Value), and Costco (Kirkland Signature) have invested heavily in their own high-quality, lower-priced private-label brands. Consumers, facing their own budget pressures, have flocked to these store brands, eroding Del Monte’s market share shelf by shelf.

- Startup Brands: The food space is filled with agile startups focused on healthy, convenient snacks and meals. These direct-to-consumer and digitally native brands built loyal followings with targeted demographics that legacy brands like Del Monte struggled to reach effectively.

The Ripple Effect: Who Is Most Affected by the Del Monte Bankruptcy?

A bankruptcy of this scale is not an isolated event. It creates far-reaching consequences that touch thousands of lives and businesses.

The Human Cost: Employees and Their Families

The most immediate and painful impact is on Del Monte’s workforce. From corporate offices to processing plants and distribution centers, widespread layoffs are an unfortunate certainty in restructuring. Factory towns that have relied on Del Monte as a primary employer for generations face economic devastation. Furthermore, the future of employee pension plans and healthcare benefits becomes uncertain, subject to the outcomes of the bankruptcy court proceedings.

The Agricultural Backbone: Farmers and Growers

For decades, multi-generational family farms have built their entire business around contracts to grow produce for Del Monte. Bankruptcy allows the company to potentially reject or renegotiate these contracts, leaving farmers with fields of crops they may not be able to sell elsewhere on short notice. This could lead to a wave of financial distress throughout America’s heartland.

The Financial Fallout: Investors and Shareholders

Under a Chapter 11 filing, the hierarchy of repayment puts shareholders last. The value of Del Monte’s stock will likely be wiped out entirely. Bondholders and other lenders will face negotiations and will likely only recover a fraction of their investment. This serves as a stark reminder of the risks involved in investing in highly leveraged companies facing secular decline.

The End Consumer: Changes in the Grocery Aisle

What will you see at the supermarket?

- Less Variety: Unprofitable product lines will be cut. You might find fewer options for specialty canned fruits or vegetables from the brand.

- Potential for Consolidation: Competitors like B&G Foods or private label manufacturers will quickly move to fill the void, potentially leading to less competition and, in the long term, less pressure on prices.

- Brand Uncertainty: The Del Monte brand itself might be sold off to another company or private equity firm, which could change the quality and identity of the products over time.

What’s Next for Del Monte? The Path Through Bankruptcy

The road ahead is complex. Del Monte’s management, under the supervision of the court, will explore several options:

- Successful Restructuring: This is the ideal outcome. The company sheds debt, closes unprofitable facilities, streamlines operations, and emerges as a smaller but more financially stable entity focused on its most profitable core products.

- Sale of Assets: The company may sell off some of its most valuable brands (e.g., Contadina, College Inn) individually to raise cash to pay creditors.

- Acquisition: A competitor or a private equity firm could acquire the entire company out of bankruptcy, seeking to turn it around with a new strategy and capital infusion.

The outcome of the Del Monte Foods Bankruptcy 2025 will take many months, if not years, to unfold. For now, the company will continue to ship products and operate as a “debtor-in-possession.”

Frequently Asked Questions about the Del Monte Foods Bankruptcy 2025

1. Will Del Monte Foods go out of business completely?

Not necessarily. The Chapter 11 filing is designed for reorganization, not liquidation. The goal is for Del Monte to restructure its debt and operations to emerge as a more financially sound company, though it will likely be smaller and more focused.

2. Are Del Monte products currently on shelves safe to eat?

Yes, absolutely. A bankruptcy filing is a financial event, not a food safety issue. The company’s products on shelves and those still being produced must adhere to all FDA and USDA safety standards.

3. What caused the Del Monte Foods Bankruptcy 2025 filing?

The bankruptcy was caused by a combination of factors, including: a shift in consumer preference towards fresh foods, severe supply chain disruptions, high operational costs, a large debt load made worse by rising interest rates, and intense competition from private-label store brands.

4. Will the prices of canned goods go up because of this?

It’s possible. With a major competitor in distress, other brands might feel less pressure to keep prices low. Additionally, if the market consolidates and there are fewer players, competition decreases, which can lead to higher prices for consumers in the long run.

5. Who is most likely to buy Del Monte’s assets?

Potential buyers could include: rival food conglomerates looking to acquire iconic brands at a discount, or private equity firms that specialize in turning around distressed companies. Portions of the business could be sold off to different buyers.

The Del Monte Foods Bankruptcy 2025 is a watershed moment for the American food industry. It’s a powerful story of a legacy brand that struggled to adapt quickly enough to a tidal wave of change. The “perfect storm” of evolving consumer tastes, supply chain crises, heavy debt, and relentless competition serves as a stark lesson for any company, in any sector, that relies on past glory rather than future-focused innovation.

As we watch this process unfold, the key takeaway is clear: no brand is too big to fail. The companies that will thrive in the 21st century are those that remain agile, listen intently to their customers, and maintain a healthy balance sheet prepared for an uncertain world.

What are your thoughts on Del Monte’s collapse? Share your perspective in the comments below, and please share this article with anyone interested in the future of our food system.

is a senior business analyst and content strategist with over 18 years of experience covering the CPG and retail sectors. He specializes in breaking down complex financial news into clear, actionable insights for investors and consumers alike. When he’s not analysing market trends, he’s experimenting with new recipes in his own kitchen.

“AJH WORLD”is a senior business analyst and content strategist with over 15 years of experience covering the CPG and retail sectors. He specializes in breaking down complex financial news into clear, actionable insights for investors and consumers alike. When he’s not analysing market trends, he’s experimenting with new recipes in his own kitchen.

Disclaimer

This article is a hypothetical analysis based on the provided prompt’s fictional scenario: “Del Monte Foods Files for $1 Billion Bankruptcy: What Led to the Collapse and Who’s Affected.” As of the date of writing, Del Monte Foods, Inc. is not in bankruptcy. This post is for illustrative purposes to showcase content creation based on a specific prompt.

Leave a Comment