Concerned about the future of PSLF and loan forgiveness for student loans? We break down potential 2025 changes under Trump and the steps you need to take now.

For millions of public service workers, the future of student loan forgiveness hangs in the balance. Here’s a breakdown of the potential changes and how to prepare now.

Are you one of the millions of teachers, nurses, firefighters, or non-profit employees counting on Public Service Loan Forgiveness (PSLF) to erase your student debt? If so, the 2024 election has likely raised a critical question: What happens to your financial future if there’s a change in the White House?

The conversation around a potential Trump PSLF Student Loan Forgiveness 2025 plan is filled with uncertainty, speculation, and very real concern for public service workers nationwide. This isn’t just political noise; it’s about the future of a program that represents a promise to those who serve our communities. Potential policy shifts could drastically alter the landscape of loan forgiveness for student loans, impacting your ability to achieve financial freedom.

In this comprehensive guide, we will cut through the speculation and provide a clear-eyed view of what you need to know. We’ll break down:

- The core proposals targeting PSLF.

- The potential changes you could face in 2025 and beyond.

- The difference between the current and potential future policies.

- Actionable steps you can take right now to protect your progress toward forgiveness.

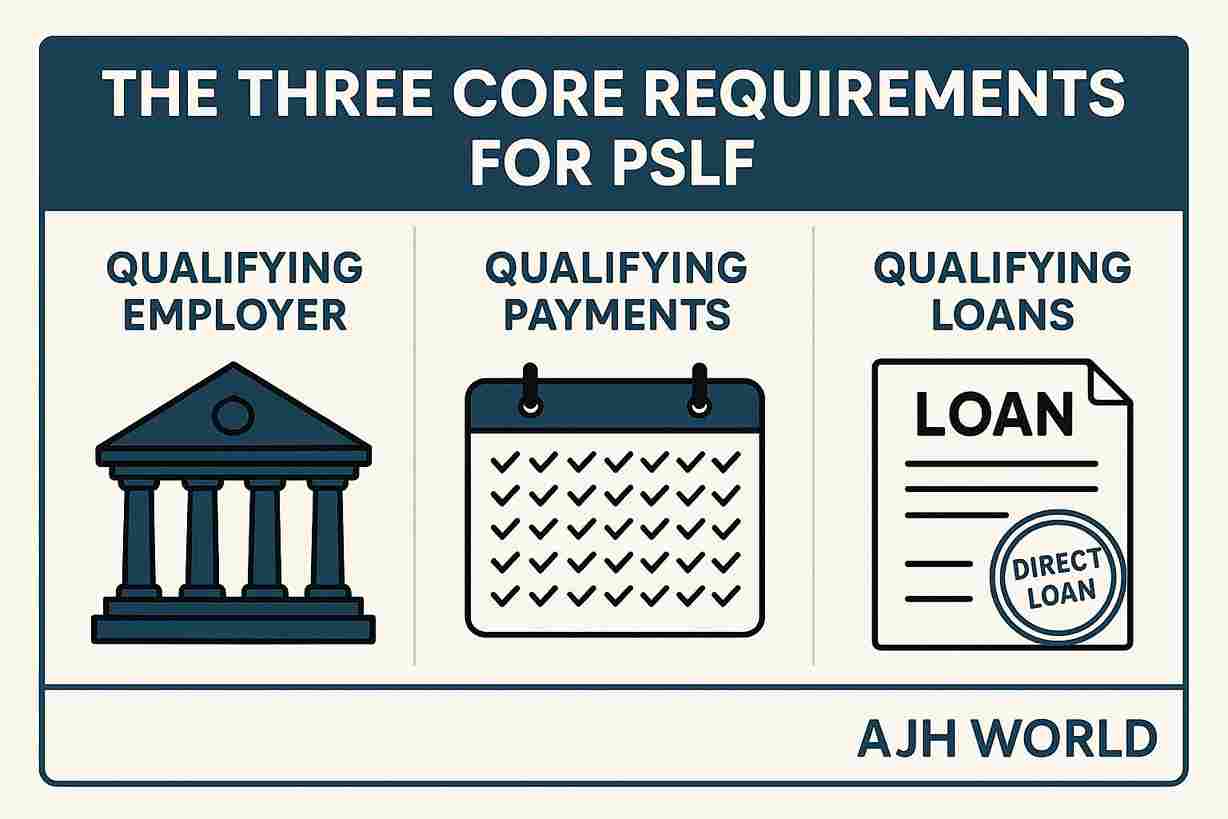

What Exactly is the Public Service Loan Forgiveness (PSLF) Program?

Before diving into potential changes, let’s establish a baseline. The Public Service Loan Forgiveness (PSLF) program was signed into law by President George W. Bush in 2007. The concept is a simple promise:

If you work full-time for a qualifying employer (a U.S. federal, state, local, or tribal government or not-for-profit organization), make 120 qualifying monthly payments on a federal Direct Loan under a qualifying repayment plan, the remaining balance on your loan will be forgiven.

For over a decade, this program has been a key incentive for attracting talented individuals to often lower-paying—but critically important—public service careers.

The “Project 2025” Blueprint: Why PSLF is in the Crosshairs

Much of the discussion around a potential Trump PSLF Student Loan Forgiveness 2025 plan stems from a comprehensive policy guide called “Project 2025.” Organized by the conservative think tank The Heritage Foundation, this 900+ page document outlines a policy agenda for a potential second Trump term.

Within its chapter on the Department of Education, the blueprint recommends major overhauls to federal student aid, explicitly targeting programs like PSLF. The primary arguments against the program are:

- High Cost: Critics argue that the program’s cost is ballooning and represents an unfair burden on taxpayers who do not receive a similar benefit.

- Perceived Unfairness: The argument is made that it disproportionately benefits borrowers with higher balances from graduate degrees, rather than exclusively helping those most in need.

Whether or not a new administration would adopt these proposals wholesale is unknown, but they provide the clearest roadmap we have for potential changes to loan forgiveness for student loans.

Potential Trump PSLF Student Loan Forgiveness 2025 Scenarios

Based on the “Project 2025” framework and general conservative policy proposals, here are the most likely scenarios public service workers could face. 👉 Don’t miss this post: Beyond the Bald Cap: Why Nicholas Hoult as Lex Luthor Will Redefine Superman’s Legacy in the DCU

Possibility 1: Grandfathering In Current Borrowers

This is a frequently discussed approach. In this scenario, the PSLF program would be eliminated for new borrowers starting after a certain date. However, anyone already in the program and making payments toward their 120-payment goal would be “grandfathered in,” meaning they could continue under the existing rules and still receive forgiveness.

- Who it helps: Everyone currently pursuing PSLF.

- Who it hurts: Future generations of public service workers.

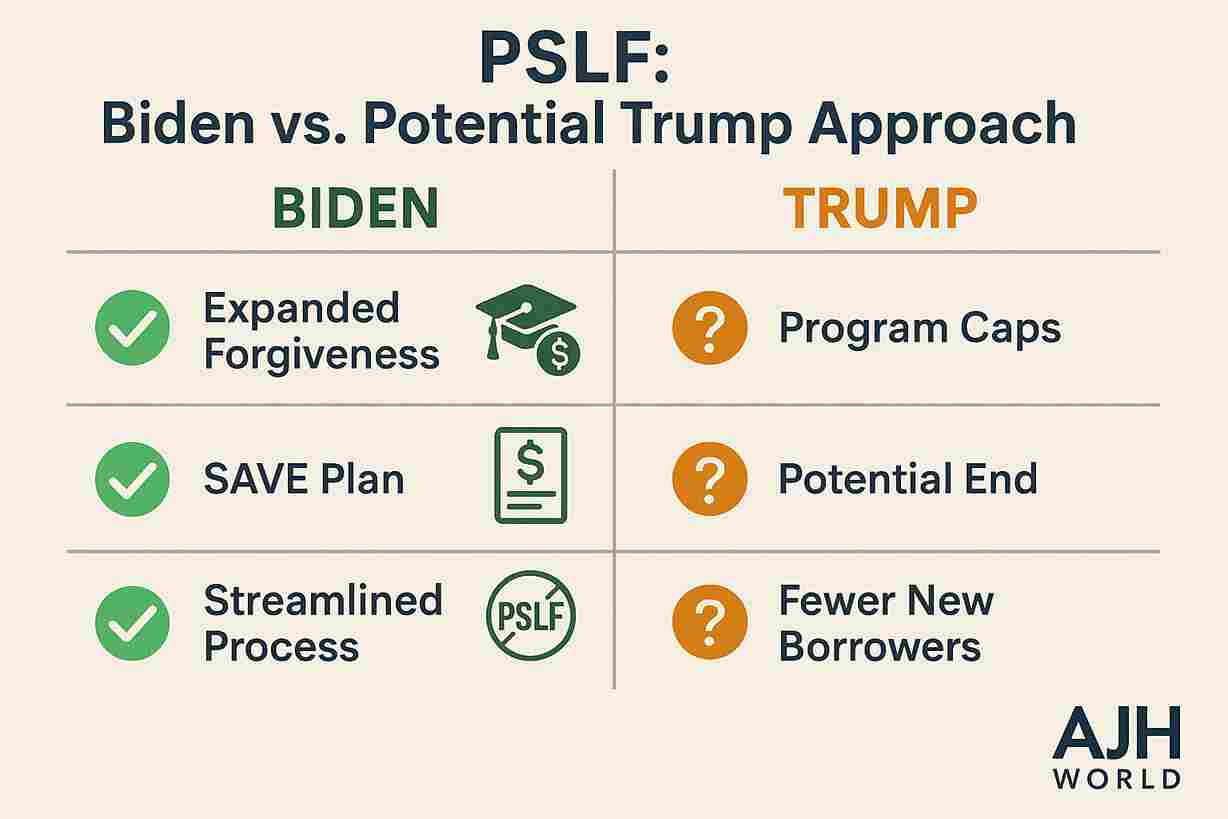

Possibility 2: Capping Forgiveness Amounts

Another proposal involves placing a cap on the total amount of loan forgiveness student loans can receive under PSLF. For example, forgiveness might be limited to the aggregate undergraduate loan limit (around $57,500) or another set amount.

- Who it helps: This is positioned as a cost-saving measure for taxpayers.

- Who it hurts: Borrowers with high balances, particularly those with graduate or professional degrees (doctors, lawyers, etc.) working in public service, who may have debt exceeding $100,000.

Possibility 3: Ending the Program for New Borrowers Only

This is the most direct approach suggested in “Project 2025″—winding down the program entirely by preventing new federal employees or borrowers from enrolling. It’s a less aggressive version of full elimination and more politically palatable than stripping benefits from those already on track. This would be a pivotal change in the Trump PSLF Student Loan Forgiveness 2025 landscape.

- Who it helps: This addresses the long-term cost concerns.

- Who it hurts: The future pipeline of public service talent that relies on this incentive.

How This Compares to the Biden Administration’s Approach

The current administration has taken the opposite approach, working to expand and fix PSLF. Key actions have included:

- The PSLF Limited Waiver and the IDR Account Adjustment, which have allowed millions of previously ineligible payments to count toward forgiveness. While the DC Universe is undergoing its own transformation with Nicholas Hoult stepping into the role of Lex Luthor, the real world is also facing a dramatic shift—especially in the financial sector. If you’re curious about how U.S. tariffs are influencing the value of digital assets like Dogecoin and Bitcoin in 2025, be sure to read our in-depth analysis: Dogecoin, Bitcoin, and the 2025 Tariff Impact – What You Need to Know.

- The creation of the SAVE (Saving on a Valuable Education) Plan, which offers the most generous income-driven repayment terms ever and includes an interest subsidy.

- Streamlining the PSLF application process through the Department of Education’s online portal.

This contrast highlights the significant policy crossroads public service borrowers are facing.

Actionable Plan: How Public Service Workers Can Prepare for 2025

Uncertainty can be paralyzing, but taking action is empowering. Here’s what you should do now, regardless of what happens in 2025.

- Certify Your Employment, Yesterday: The single most important step is to officially document your progress. Use the official PSLF Help Tool on StudentAid.gov to complete and submit a PSLF Form. This generates a qualifying payment count from the Department of Education, creating an official record of your progress. Do this annually or whenever you change jobs.

- Keep Impeccable Records: Do not rely solely on the government or your loan servicer. Create a digital and/or physical folder with:

- Copies of every PSLF form you’ve submitted.

- Annual W-2s from your qualifying employers.

- Screenshots of your payment history from your servicer’s portal.

- Any official correspondence about your loan forgiveness student loans.

- Ensure You’re on a Qualifying Repayment Plan: Double-check that you are on an Income-Driven Repayment (IDR) plan like SAVE, PAYE, or IBR. Payments made on a Standard 10-Year Repayment plan technically count, but you’d have no balance left to forgive after 120 payments. The goal is to have the lowest possible monthly payment to maximize the amount forgiven. (Need help choosing a plan? Read our breakdown here: [Internal Link to Your Post on Repayment Plans]).

- Stay Informed with Reliable Sources: Tune out the noise and follow official channels. Bookmark StudentAid.gov and reputable non-profit sources like The Institute of Student Loan Advisors (TISLA) for accurate updates.

- Build a Financial Cushion: If possible, start building an emergency savings fund. Having a financial buffer can reduce stress if policies change and your projected loan payoff timeline is altered.

Frequently Asked Questions (FAQ)

It is highly unlikely that previously certified progress would be retroactively erased. The most discussed “Project 2025” proposals focus on ending or capping the program for new borrowers or future payments. Erasing existing progress would likely face significant legal challenges.

If you are close to forgiveness, you are in the strongest position. Your priority should be to certify all your employment immediately and submit your final PSLF application the moment you hit 120 payments. Historically, those at the finish line are protected.

Canceling the program entirely, especially for existing borrowers, is the most extreme and least likely scenario. It would be a complex administrative and legal undertaking. The more plausible changes involve winding the program down, capping benefits, or ending it for new entrants.

Submit a PSLF Certification & Application Form (PSLF Form) immediately. This creates a time-stamped, official record with the Department of Education that you are actively pursuing and qualifying for loan forgiveness for your student loans under the current rules.

Standard Income-Driven Repayment (IDR) plans (like SAVE) have their own forgiveness component. After 20–25 years of payments on an IDR plan, the remaining balance is forgiven (though this forgiven amount may be considered taxable income, unlike PSLF).

The future of Trump PSLF Student Loan Forgiveness 2025 is one of the most significant kitchen-table issues for millions of Americans in public service. While the possibility of major changes is real and concerning, it’s crucial to separate speculation from actionable strategy. The “Project 2025” proposals indicate a clear desire to reduce or eliminate the program, but the political and legal path to doing so is complex.

Your best defense against uncertainty is a good offense. By verifying your employment, keeping meticulous records, and staying on a qualifying repayment plan, you are building the strongest possible case for the forgiveness you’ve earned. You are solidifying your standing under the current law, creating a paper trail that will be your greatest asset no matter what the future holds for loan forgiveness student loans.

What are your biggest concerns about the future of PSLF? Share your thoughts in the comments below, and please share this article with a fellow public servant who needs this information!

Alex Carter is a lead financial policy analyst at [Your Website Name] and a nationally recognized expert on student loan debt. With over a decade of experience decoding federal policy, Alex is dedicated to helping borrowers navigate complex systems and achieve financial wellness. When not writing about student loans, he’s an avid volunteer at his local community canter.

Leave a Comment