Is a $3000 IRS tax refund coming June 2025? Get clarity on the schedule rumors, real eligibility, and official IRS info. Learn about the $3000 IRS tax refund schedule 2025.

Unpacking the speculation: Is a $3000 IRS tax refund coming in June 2025? Understand potential eligibility, how refunds really work, and where to get official updates.

Is the internet buzzing in your circles about a potential $3000 IRS tax refund schedule 2025 for June? You’re not alone. Talk of significant tax refunds or stimulus payments often sparks widespread interest and, understandably, a lot of questions. With memories of past economic impact payments and various tax credits, it’s natural to wonder if another financial boost is on the horizon for June 2025.

This topic matters because timely, accurate information about your taxes can significantly impact your financial planning. Misinformation can lead to confusion or, worse, vulnerability to scams. This post aims to cut through the noise. We’ll explore what might be fueling these discussions, how IRS tax refunds actually work, what factors could lead to a refund of this size, and most importantly, how to verify any claims. By the end of this guide, you’ll have a clearer understanding of the rumored $3000 IRS tax refund schedule 2025 and be equipped to find official, trustworthy information.

Understanding the $3000 IRS Tax Refund June 2025 Buzz

Have you heard whispers or seen posts about a $3000 IRS tax refund schedule 2025 set for June? It’s crucial to approach such news with a critical eye. Let’s break down why these discussions might be happening and what to look for.

Where Do These Rumors Come From?

Information, and sometimes misinformation, spreads rapidly online. Rumors about large, specific refund amounts often stem from a few sources:

-

Misinterpretation of Past Programs: Previous stimulus payments (Economic Impact Payments) or enhanced tax credits (like the temporarily expanded Child Tax Credit) might lead people to expect similar future payments.

-

Speculation about Future Legislation: Discussions about potential new laws or changes to existing tax codes can be taken out of context or prematurely reported as fact.

-

Social Media Amplification: A single unverified post can quickly gain traction, leading many to believe it’s official news.

-

Clickbait Articles: Some websites may sensationalize potential tax changes to drive traffic, without clearly stating the speculative nature of the information.

-

Confusion with Existing Credits: Taxpayers who consistently receive large refunds due to multiple credits might discuss their “average” refund, which others misinterpret as a new, universal payment.

It’s important to remember that unless announced directly by the IRS or through official government channels, specific payment amounts and dates like a “$3000 refund in June 2025” are speculative.

Official IRS Stance (Hypothetical until confirmed)

As of our last update [Insert Current Date], the Internal Revenue Service (IRS) has NOT made any official announcement regarding a specific, universal “$3000 tax refund” designated for distribution in June 2025.

The IRS communicates major changes to tax law, new credits, or special payment distributions through:

-

Its official website: IRS.gov

-

Official press releases

-

Updates to tax forms and instructions

Always refer to these official sources before assuming any widespread payment is scheduled. We will monitor and update this section if any official news regarding a $3000 IRS tax refund schedule 2025 is released.

How IRS Tax Refunds Typically Work

Before diving deeper into the specifics of a potential $3000 refund, it’s essential to understand how IRS tax refunds operate in general. A tax refund isn’t free money; it’s typically a reimbursement of excess taxes you’ve already paid throughout the year.

The Tax Filing Process

-

Earning Income & Paying Taxes: Throughout the year, income tax is withheld from your paychecks (W-2 employees) or paid via estimated tax payments (self-employed, gig workers, investors).

-

Filing a Tax Return: By the annual tax deadline (usually April 15th), you file a tax return (e.g., Form 1040). This return reports your total income, claims eligible deductions and credits, and calculates your total tax liability for the year.

-

Reconciliation:

-

If the total tax you paid during the year is more than your actual tax liability, you are due a refund.

-

If you paid less than your tax liability, you owe additional taxes.

-

Factors Influencing Your Refund Amount

Many variables determine whether you get a refund and how large it might be:

-

Income Level: Your total taxable income.

-

Withholding Amount/Estimated Payments: How much tax was taken out of your pay or you paid in advance. Accuracy here is key (Form W-4).

-

Filing Status: Single, Married Filing Jointly, Married Filing Separately, Head of Household, Qualifying Widow(er).

-

Dependents: Claiming eligible children or other dependents.

-

Tax Deductions: These reduce your taxable income (e.g., standard deduction, itemized deductions like mortgage interest, state and local taxes (SALT cap), medical expenses, charitable contributions).

-

Tax Credits: These directly reduce your tax liability, dollar for dollar, and are often more impactful than deductions. Some are even refundable, meaning you can get them back even if they exceed your tax liability.

A $3000 IRS tax refund is certainly possible for many filers, but it usually results from a combination of these factors, particularly significant refundable credits or over-withholding, not typically from a standalone, universal payment outside of major economic relief packages.

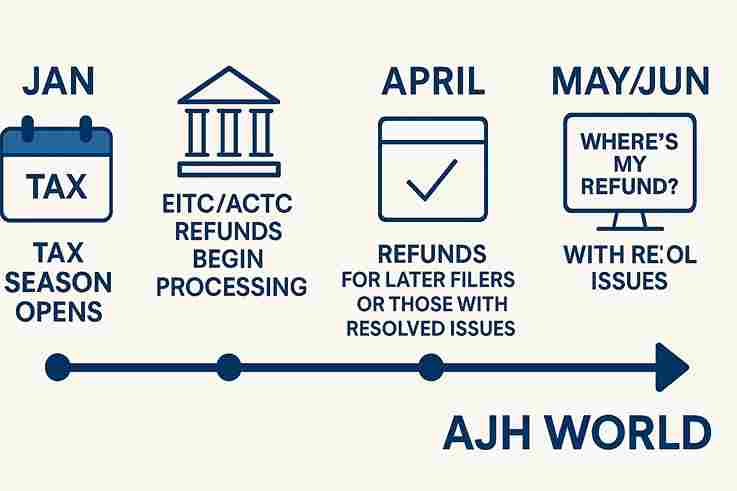

Standard Refund Timelines

The IRS typically issues most refunds in less than 21 calendar days after the tax return is electronically filed and accepted, provided there are no issues with the return. However:

-

Paper-filed returns: Take much longer, potentially 6-8 weeks or more.

-

Returns claiming certain credits: Returns claiming the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) may, by law (PATH Act), have refunds held until mid-February to allow the IRS additional time to detect and prevent fraud.

-

Errors or Incomplete Returns: Any mistakes or missing information can cause significant delays.

-

Identity Theft/Fraud Reviews: If the IRS suspects identity theft, your refund will be delayed pending review.

A specific $3000 IRS tax refund schedule 2025 for June for everyone would be highly unusual unless it’s a special, congressionally mandated payment separate from the regular tax filing process. For regular refunds from 2024 tax year filings (done in early 2025), June would be quite late unless there were issues or if someone filed very late with an extension.

Could You Be Eligible for a $3000 Refund in 2025? (Based on Existing/Potential Tax Laws)

While a specific “$3000 universal refund” for June 2025 is unconfirmed, it’s entirely plausible for an individual or family to receive a tax refund of $3000 or more based on their specific circumstances and the tax laws in effect for the 2024 tax year (filed in 2025).

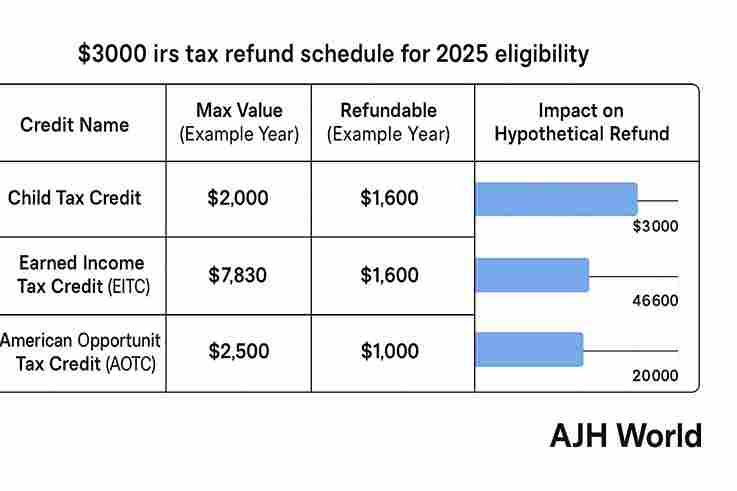

Key Tax Credits to Watch

Tax credits are powerful tools for reducing your tax bill and potentially increasing your refund. Here are some major ones (amounts and rules can change annually due to legislation, so these are general descriptions):

Child Tax Credit (CTC)

-

What it is: A credit for taxpayers with qualifying dependent children.

-

Potential Value: For the 2023 tax year, it was up to $2,000 per child, with up to $1,600 being refundable (the Additional Child Tax Credit or ACTC).

-

Future Changes: The CTC has been a subject of much debate. It was temporarily expanded for 2021. Future legislation could alter its value and refundability for 2024 and beyond. Achieving a significant portion of a $3000 refund could come from this credit alone if you have multiple children or if the credit is enhanced.

Earned Income Tax Credit (EITC)

-

What it is: A refundable credit for low- to moderate-income working individuals and families.

-

Potential Value: Varies significantly based on income, filing status, and number of qualifying children. It can range from a few hundred to over $7,000 (for 2023, maximum was $7,430 for those with 3 or more children).

-

Impact: The EITC is a major anti-poverty tool and can result in substantial refunds.

American Opportunity Tax Credit (AOTC)

-

What it is: A credit for qualified education expenses paid for an eligible student for the first four years of higher education.

-

Potential Value: Up to $2,500 per eligible student, with 40% (up to $1,000) being refundable.

-

Impact: If you or a dependent are in college, this can be a significant boost.

Other Deductions and Credits

-

Child and Dependent Care Credit: Helps pay for the care of qualifying individuals so you can work or look for work.

-

Saver’s Credit (Retirement Savings Contributions Credit): For eligible taxpayers who contribute to an IRA or employer-sponsored retirement plan.

-

Premium Tax Credit: Helps eligible individuals and families cover premiums for health insurance purchased through the Health Insurance Marketplace.

-

Various energy credits, adoption credits, etc.

Combining Credits for a Larger Refund

It’s often the combination of several credits, along with strategic tax planning (like maximizing pre-tax contributions to retirement accounts if applicable, or accurate W-4 withholding), that leads to larger refunds.

Example Scenario (Illustrative – based on 2023 rules, subject to change for 2024/2025):

A married couple filing jointly with two young children and a moderate income might claim:

-

Child Tax Credit: $2,000 per child x 2 = $4,000 (up to $1,600 per child refundable)

-

Earned Income Tax Credit: Potentially $2,000 – $6,000 depending on income.

If their total tax liability before these refundable credits was, say, $1,000, and they had $1,000 withheld: -

Tax liability reduced to $0 by non-refundable portions of credits.

-

Remaining refundable credits could easily total

3,000ormore(1600 ACTC + $1600 ACTC + portion of EITC).

-

Add back the $1,000 already withheld, and their refund could be substantial.

This shows how a

3000+refundisachievablewithoutaspecial"universal"payment. Understandingeligibilityforthesecreditsiskeywhenconsideringany∗∗3000 IRS tax refund schedule 2025**.

The “Schedule” Aspect: When Would Refunds Arrive?

Regarding the “June 2025” part of the rumored $3000 IRS tax refund schedule 2025:

General IRS Refund Processing Timelines

-

Early Filers (Late Jan/Early Feb): Those who file early and accurately, especially with direct deposit, often see refunds within 7-21 days. EITC/ACTC filers typically see refunds starting late February.

-

Mid-Season Filers (March/Early April): Similar 21-day target, but volume can sometimes cause slight variations.

-

Extension Filers/Late Filers (After April 15 up to Oct 15): Refunds are processed as returns come in. A refund received in June would be common for someone who filed in mid-to-late May or had minor issues with an earlier filing.

A special government payment (like past stimulus checks) could theoretically be scheduled for June. However, for regular tax refunds from the 2024 tax year filing season, June is generally:

-

Normal for those who filed an extension and submitted their return in May.

-

Late for those who filed accurately by the April deadline without issue.

-

Possible if a return was flagged for review or had errors that took time to resolve.

Factors Affecting Your Specific Refund Date

-

Filing Method: E-file with direct deposit is fastest. Paper filing is slowest.

-

Accuracy of Return: Errors cause delays.

-

Credits Claimed: EITC/ACTC refunds are held until mid-February by law.

-

IRS Workload & System Checks: Fraud detection and identity verification can add time.

-

Bank Processing Time: Once the IRS sends the refund, your bank may take a few days to post it.

How to Track Your Refund (Official Methods)

The IRS provides two main ways to track your refund status for your filed tax return:

-

“Where’s My Refund?” tool on IRS.gov: Available 24 hours after e-filing or 4 weeks after mailing a paper return. You’ll need your Social Security number, filing status, and exact refund amount.

-

IRS2Go mobile app: Offers the same functionality as the website tool.

Important: These tools track refunds from your filed tax return. They would NOT track a hypothetical, separate universal $3000 payment unless the IRS specifically directed people to use them for that purpose. For any special payment, the IRS would provide unique tracking instructions.

Verifying Information: Don’t Fall for Misinformation or Scams

Whenever money from the government is discussed, especially specific amounts like a “$3000 tax refund,” scammers and misinformation peddlers emerge. It’s vital to protect yourself.

The Official Source: IRS.gov

The ONLY official source for information about your federal taxes, tax refunds, or any special IRS-administered payments is IRS.gov.

-

Look for official news releases in their “Newsroom” section.

-

Check for updates on relevant tax credit pages.

-

Never rely on social media posts, forwarded emails, or calls from unknown individuals for definitive tax information.

Red Flags for Tax Scams

Scammers often try to capitalize on refund buzz. Be wary of:

-

Unsolicited Emails/Texts/Calls: The IRS primarily communicates via postal mail. They don’t initiate contact via email, text, or social media to request personal or financial information.

-

Threats or Urgency: Scammers try to pressure you into acting quickly (e.g., “Your account will be suspended,” “You’ll be arrested”). The IRS doesn’t do this.

-

Requests for Personal/Financial Info: Don’t provide your SSN, bank account details, or credit card numbers via unsolicited contact.

-

Demands for Payment via Gift Cards, Wire Transfers, Cryptocurrency: The IRS will never demand payment this way.

-

Links to Fake Websites: Always type IRS.gov directly into your browser. Don’t click suspicious links.

-

Promises of a “Guaranteed” $3000 Refund: Especially if they ask for an upfront fee to “claim” it. Your refund depends on your specific tax situation.

If you encounter a scam or suspicious communication related to the $3000 IRS tax refund schedule 2025 or any other tax matter, report it to the Treasury Inspector General for Tax Administration (TIGTA) and the Federal Trade Commission (FTC).

What to Do Now to Prepare for the 2025 Tax Season

Regardless of whether a specific “$3000 refund” materializes, good preparation for the 2025 tax season (filing your 2024 taxes) is always beneficial:

-

Organize Your Tax Documents: Keep W-2s, 1099s, receipts for deductions/credits, and records of any estimated tax payments in one place.

-

Stay Informed (Officially): Bookmark IRS.gov and check it periodically for legitimate updates on tax law changes for 2024.

-

Adjust Withholding if Needed: If you consistently owe a lot or get unexpectedly massive refunds, consider adjusting your W-4 withholding with your employer. The IRS Tax Withholding Estimator tool can help.

-

Consider Using Tax Software or a Professional: These can help you identify all eligible credits and deductions.

-

Plan for Direct Deposit: It’s the fastest and safest way to receive any refund you’re due.

Read more :

Get Your Chili Cheese Dogs Ready: Wienerschnitzel Sizzles into Reno Walmart in 2025!

By staying organized and informed, you’ll be in the best position to accurately file your 2025 taxes and receive any refund you’re entitled to, including one that might be around the $3000 mark due to your specific circumstances.

Q2: Who would be eligible for a $3000 tax refund from the IRS?

A2: Eligibility for a $3000 tax refund depends on individual circumstances, including income, filing status, dependents, deductions, and tax credits claimed (like the Child Tax Credit or Earned Income Tax Credit). It's typically a result of overpaying taxes throughout the year or qualifying for significant refundable credits, not a standalone payment.

Q3: If there were a special

3000IRSpayment,whenwouldweknowabouttheschedule?∗∗∗∗A3:∗∗IfCongressweretoauthorizeanewspecialpayment,detailslikethe∗∗3000 IRS tax refund schedule 2025 (including eligibility and timing) would be announced by the IRS and Treasury Department through official channels, primarily IRS.gov. This would likely happen closer to the actual implementation date.

Q4: How can I check the status of my actual tax refund?

A4: You can check the status of your tax refund for a filed return by using the "Where's My Refund?" tool on IRS.gov or the IRS2Go mobile app. You'll need your Social Security number, filing status, and the exact refund amount. This tool tracks regular refunds, not speculative payments.

Q5: What should I do if I see social media posts about a guaranteed

3000IRStaxrefundschedule2025?∗∗∗∗A5:Beskeptical.∗∗∗∗∗Donotclicksuspiciouslinksorsharepersonalinformation.∗∗∗∗∗VerifytheinformationindependentlyontheofficialIRS.govwebsite.∗∗∗Beawarethatsuchpostsmightbemisinformationorpartofascam.Officialnewsaboutany∗∗3000 IRS tax refund schedule 2025 will come directly from the IRS.

Navigating tax information can be complex, especially when rumors about specific amounts like a $3000 IRS tax refund schedule 2025 for June start to circulate. While the idea of an extra $3000 is appealing, it’s crucial to remember that, as of now, there is no official confirmation of such a universal payment for June 2025.

However, receiving a $3000 tax refund (or more) is entirely possible for many taxpayers based on their individual filing situation, income, and eligibility for various tax credits like the Child Tax Credit, Earned Income Tax Credit, and others. The key is to understand how these legitimate credits work and to file accurately.

The most valuable takeaway is to always rely on official sources, primarily IRS.gov, for accurate tax information and to be wary of misinformation. Stay informed, prepare for the upcoming tax season diligently, and you’ll be best positioned to handle your tax obligations and receive any refund you are rightfully due. Understanding the details behind the $3000 IRS tax refund schedule 2025 buzz allows you to focus on facts, not fiction.

What are your thoughts? Have you heard these rumors? Share your experiences or questions in the comments below, and don’t forget to share this article to help others stay informed!

“AJH World” is dedicated to providing clear, accessible, and actionable financial and tax information. With a focus on empowering readers to navigate complex topics, we strive to be your trusted resource for staying informed.

Leave a Comment